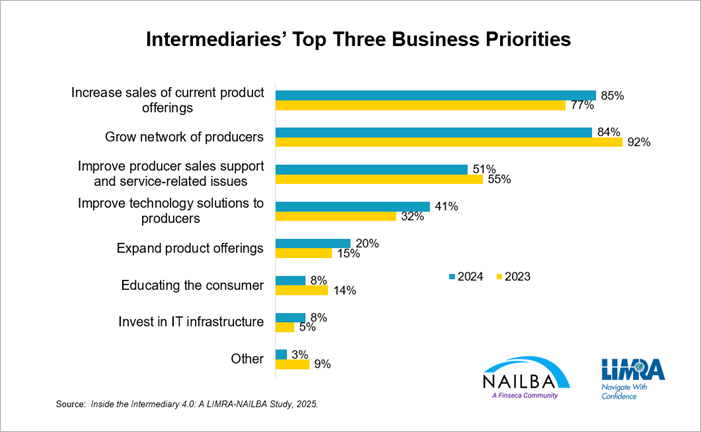

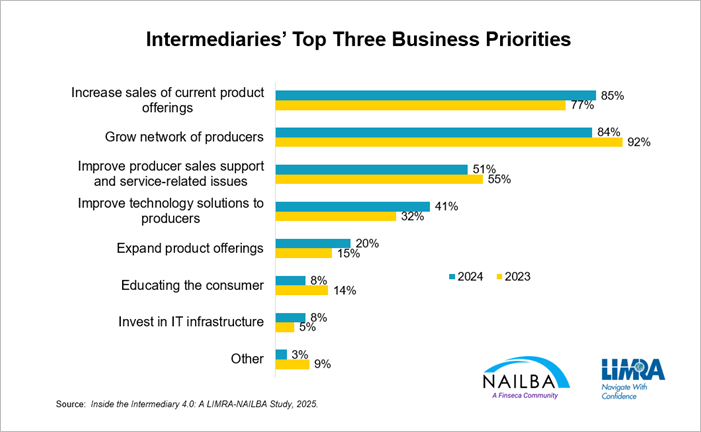

WINDSOR, Conn. and WASHINGTON, March 3, 2025 – A new report from LIMRA and the National Association of Independent Life Brokerage Agencies (NAILBA) reveals the top business priorities for insurance distribution intermediaries. The study, titled “Inside the Intermediary 4.0: A LIMRA-NAILBA Study – BGA and IMO Survey Results,” indicates that over 80% of independent marketing organizations and brokerage general agencies are focused on boosting sales of existing products and expanding their networks of financial professionals.

According to the study, nearly half (47%) of intermediaries are planning to invest in improving sales support and underwriting processes to assist their associated producers. Another 40% plan to invest in wholesaling support and prospecting for new business. “Intermediaries play a vital role in the industry, acting as an essential link, and are key to helping independent financial professionals build and grow their practices,” said Bryan Hodgens, senior vice president and head of LIMRA research. “A significant amount of retail life insurance and annuity business flows through the independent brokerage channel. The success of these producers is directly influenced by the efforts and investments of these intermediaries. This research provides key insights into the intermediary landscape and how it’s evolving, which is helping to shape the future of the life insurance industry.”

Beyond direct sales support, intermediaries are building programs to provide practice and marketing assistance, including how to target specific market segments. This includes increased investment in digital services like e-delivery, e-applications, and e-signatures. Furthermore, coaching on team building and succession planning is another area of focus.

The study also examined growth expectations. More than half the intermediaries surveyed anticipated an average growth of 21% in 2024 compared to 2023. Much of this anticipated growth is expected from partnerships with registered investment advisors and property and casualty agencies. “Understanding the evolving trends of the intermediary space is crucial for our members,” said Warren May, a leader at NAILBA. “This collaboration with LIMRA provides valuable insights that will help the brokerage community better understand market trends and position themselves for success.”

For additional information about the study’s findings, visit: Industry Insights With Bryan Hodgens: How Intermediaries Help Financial Professionals Grow Their Practice.