SBI Life Insurance’s Financial Performance Analysis

Investors often look for companies with strong growth potential and good governance. SBI Life Insurance (NSE:SBILIFE), a private life insurance company in India, has demonstrated some promising financial metrics that warrant attention.

Earnings Growth

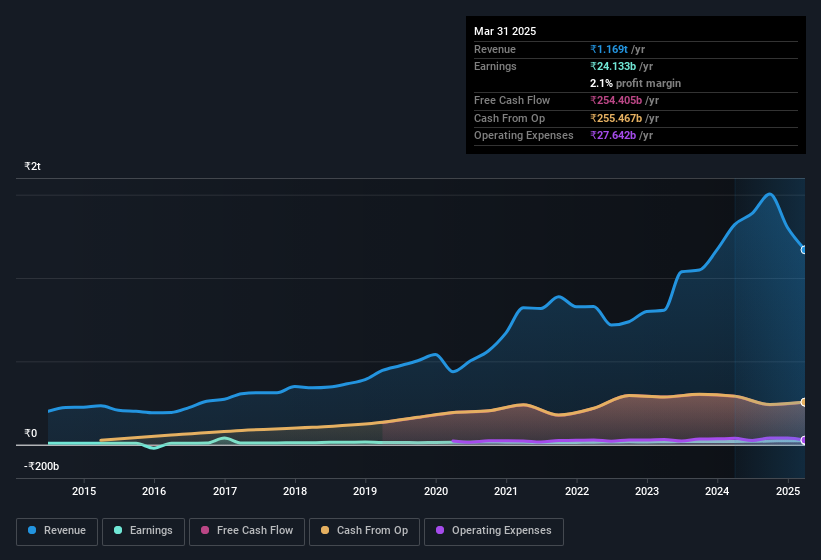

SBI Life Insurance has shown a commendable growth in earnings per share (EPS) at 17% per year over three years. This growth rate is fairly good, assuming the company can maintain it. However, a closer look at the company’s financials reveals that while EPS has grown, revenue is actually down, and earnings before interest and tax (EBIT) margins are flat. Investors should investigate the reasons behind this trend.

CEO Compensation

The CEO of SBI Life Insurance received a total compensation of ₹8.8m for the year ending March 2024, which is considered modest compared to the median total compensation of ₹100m for CEOs of similar companies with market caps over ₹677b. This modest pay packet may indicate that the CEO and the board of directors are aligned with the interests of shareholders.

Financial Health and Growth Potential

SBI Life Insurance’s solid track record and excellent balance sheet are positive indicators of its financial health. The company’s ability to generate consistent profits will be crucial in adding long-term value to shareholders. Investors may also want to consider the company’s return on equity (ROE) compared to its industry peers.

In conclusion, SBI Life Insurance is worth considering for investors looking for companies with growing EPS and reasonable CEO compensation. However, investors should conduct further research into the company’s revenue trends and overall financial health.