Japanese Insurer Dai-ichi Life Makes Strategic Investment in UK’s M&G

Dai-ichi Life, Japan’s largest listed life-insurance company, has made a significant investment in Britain’s M&G, acquiring a 15% stake worth $7.7 billion. This move serves both parties’ interests and could potentially lead to further M&A activity.

The investment is Dai-ichi Life’s latest foray into the UK market, following Meiji Yasuda Life Insurance’s announcement in February to purchase 5% of Legal & General. Japan’s aging population has driven its life insurers to seek growth opportunities abroad. Dai-ichi Life, with $29 billion in assets, has been relatively active in acquisitions, having previously purchased Alabama-based Protective Life in 2014 and acquired a stake in U.S. credit manager Canyon Partners last year.

The UK has become increasingly attractive to Japanese investors as an alternative to the U.S., particularly given the Labour government’s focus on fostering growth and private investment. While the UK population is also aging, M&G brings expertise in areas such as private credit, making it an appealing investment opportunity.

Dai-ichi Life has committed to investing at least $6 billion into M&G’s funds, with half coming from its own balance sheet. This investment demonstrates confidence in M&G CEO Andrea Rossi’s plan to revive growth by focusing on private assets and bulk annuities. The deal also “supercharges” Rossi’s plan, as JPMorgan analysts had previously expected M&G’s asset management business to bring in minimal new money this year and next.

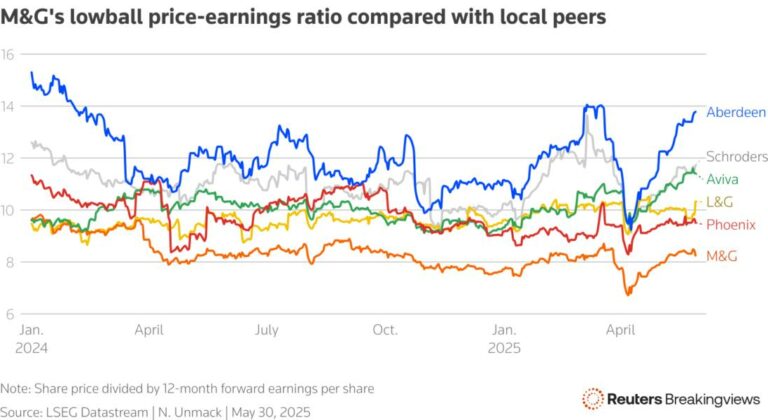

The investment raises questions about the potential for Dai-ichi Life to acquire the remainder of M&G. While the Japanese insurer has committed to not exceeding a 19.99% holding, a minority stake and board seat provide many benefits without the complexity of a full merger. M&G has been a perennial takeover target since its spin-off from Prudential in 2019, with potential suitors including private-markets giants like KKR.

Dai-ichi Life’s investment in M&G has been well-received by the market, with M&G shares rising approximately 6% to just under 240 pence following the announcement. The deal highlights the growing connection between Japanese insurers and UK financial institutions, driven by mutual interests and growth opportunities.