Life Insurance Corporation of India Surpasses Expectations

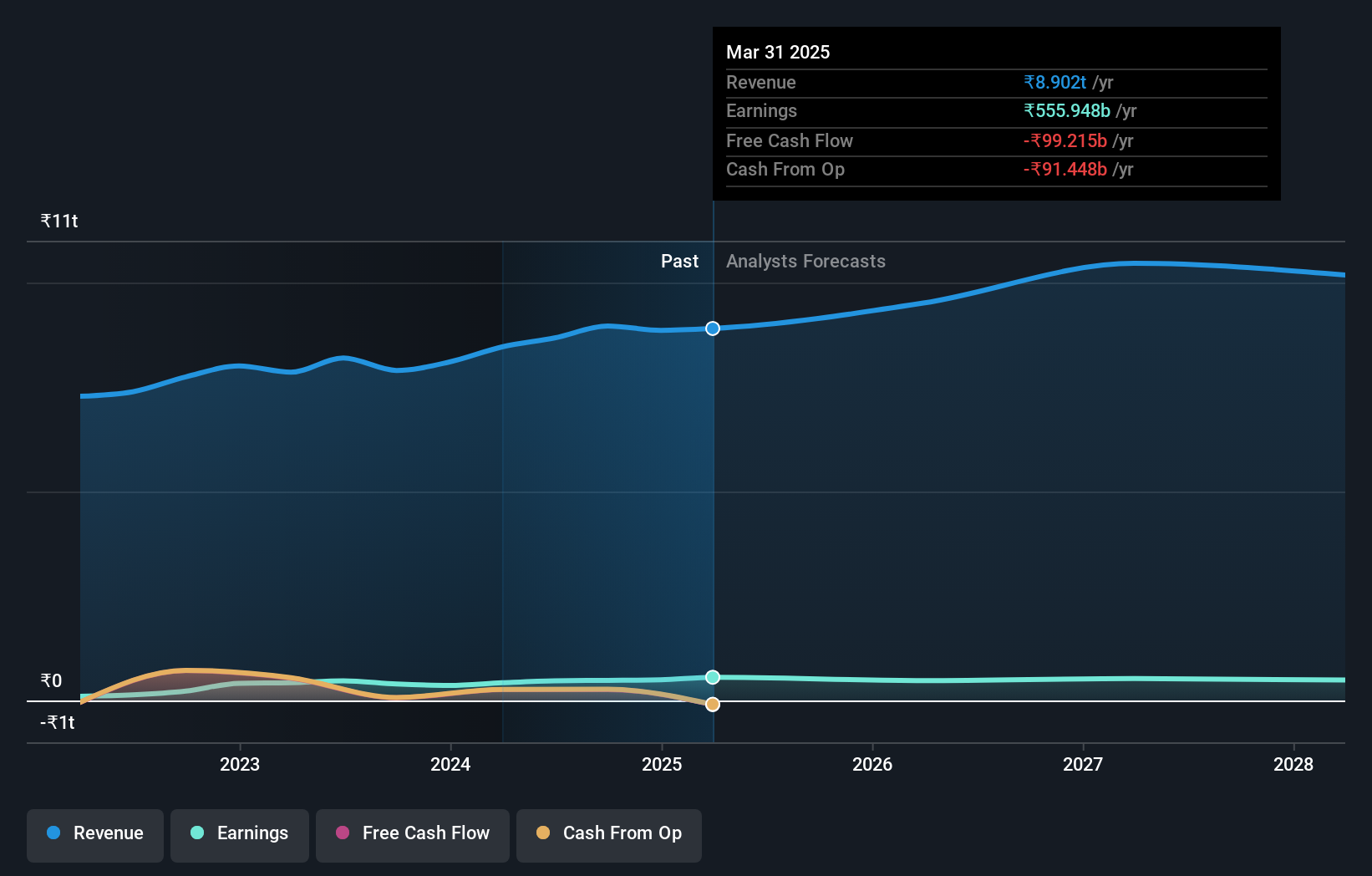

Shares of Life Insurance Corporation of India (NSE:LICI) saw a 12% increase to ₹944 following the release of its latest yearly results. The company’s revenues reached ₹8.9 trillion, aligning with expectations, while statutory earnings per share (EPS) of ₹76.40 exceeded analyst predictions by 13%.

Analysts have aggregated their forecasts, indicating a consensus revenue projection of ₹9.51 trillion for 2026, representing a 6.8% improvement from the last 12 months. However, statutory EPS is expected to decrease by 8.6% to ₹80.35 during the same period. Prior to the latest earnings announcement, analysts had anticipated higher revenues of ₹9.75 trillion and EPS of ₹79.30 for 2026. The revision suggests a slightly less optimistic outlook following the results.

Analyst Forecasts and Price Targets

The consensus price target remains at ₹1,065, indicating that the analysts do not expect the reduced revenue expectations to significantly impact Life Insurance Corporation of India’s market value. The range of individual analyst targets varies from ₹825 to ₹1,300 per share, showing diverse perspectives on the company’s valuation.

Industry Comparison and Future Outlook

Analysts forecast Life Insurance Corporation of India’s revenue to grow at an annualized rate of 6.8% through 2026, consistent with its 6.5% annual growth over the past five years. However, this growth rate is expected to lag behind the industry average of 8.9% per year. The intrinsic value of the business remains relatively stable, with long-term earnings power being a more critical factor than short-term profits.

Conclusion

While there has been no significant change in sentiment among analysts, the downgrade in revenue estimates and the expectation that the company will underperform the wider industry are notable concerns. Investors should consider the long-term earnings potential and be aware of potential risks. For a comprehensive analysis, including estimates up to 2028, investors can access additional information on the Simply Wall St platform.

You should always consider risks when evaluating investments. We’ve identified 3 warning signs for Life Insurance Corporation of India that you should be aware of.

For further details and to explore more, you can visit Simply Wall St.