Life Insurance Corporation of India’s Dividend Increase

Life Insurance Corporation of India (NSE:LICI) has announced that it will increase its dividend to ₹12.00, payable on September 25. This represents an annual payment of 1.3% of the stock price, which is above the industry average. The company’s earnings have easily covered the dividend, although its free cash flows were negative prior to this announcement.

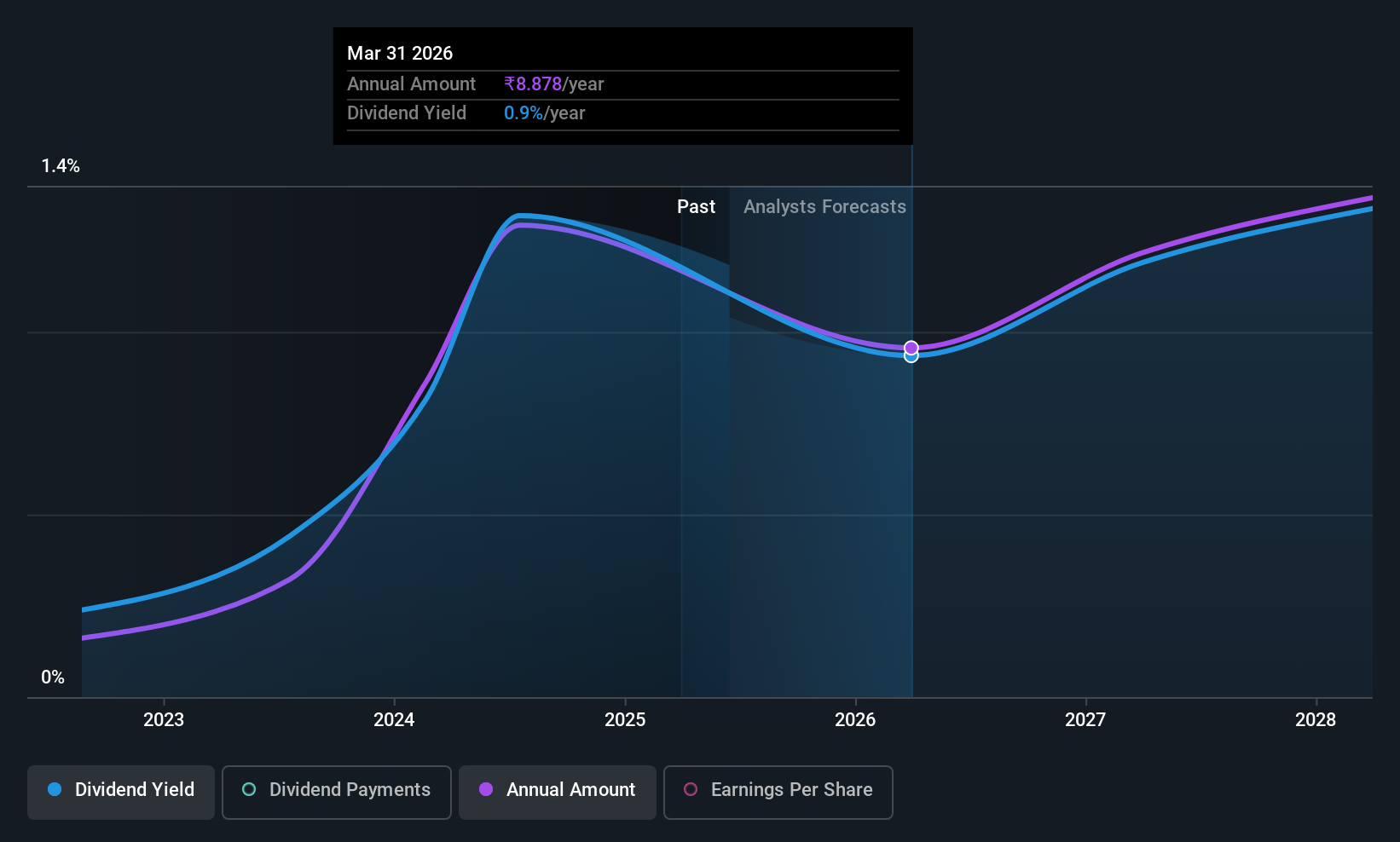

The company’s earnings per share (EPS) are expected to grow by 36.8% next year. Assuming the dividend continues along recent trends, the payout ratio could be 10.0% by next year, which is considered sustainable. However, the company’s track record of dividend payments is relatively short, having started consistent payments only since 2022. The dividend has grown from ₹1.50 to ₹12.00, representing a compound annual growth rate (CAGR) of approximately 100%.

While the dividend yield is attractive, the lack of a long-term track record and negative cash flows raise concerns about its sustainability. Life Insurance Corporation of India’s EPS has been rising at 16% per annum over the last five years, indicating decent growth. The low payout ratio suggests that the company is reinvesting well and has room to increase the dividend over time.

Overall, while the dividend is being raised, Life Insurance Corporation of India may not be an ideal income stock due to its cash flow concerns. Investors should consider multiple factors beyond dividend payments when analyzing the company. Notably, there are 3 warning signs for Life Insurance Corporation of India that investors should be aware of before investing.