Life Insurance Market Hits New Highs in 2024

According to the latest findings from LIMRA’s Retail Life Insurance Sales Survey, the life insurance industry experienced a robust year in 2024, achieving record-breaking sales for the fourth consecutive year.

Annualized life insurance premium rose 3% to $15.9 billion for the year. While policy count remained steady with 2023 figures, the increase in premium highlights the industry’s consistent growth. The organization also noted a record-high for indexed universal life (IUL) sales and a significant increase in variable universal life (VUL) sales.

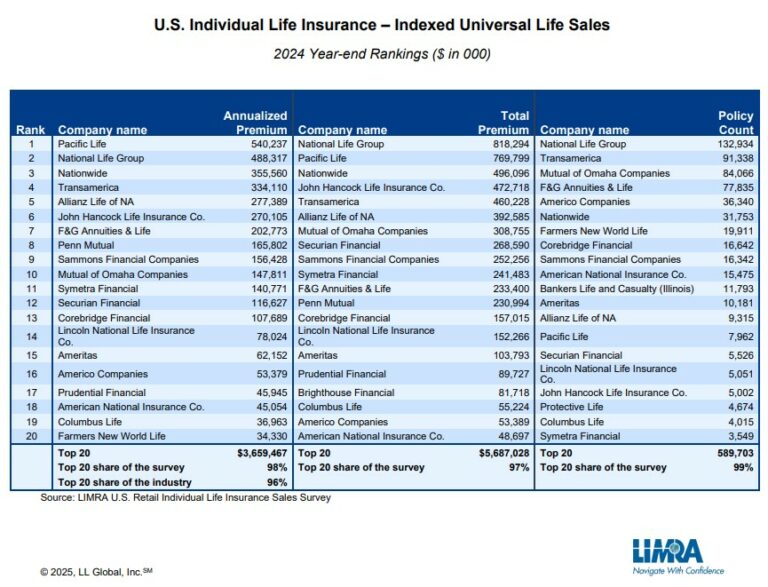

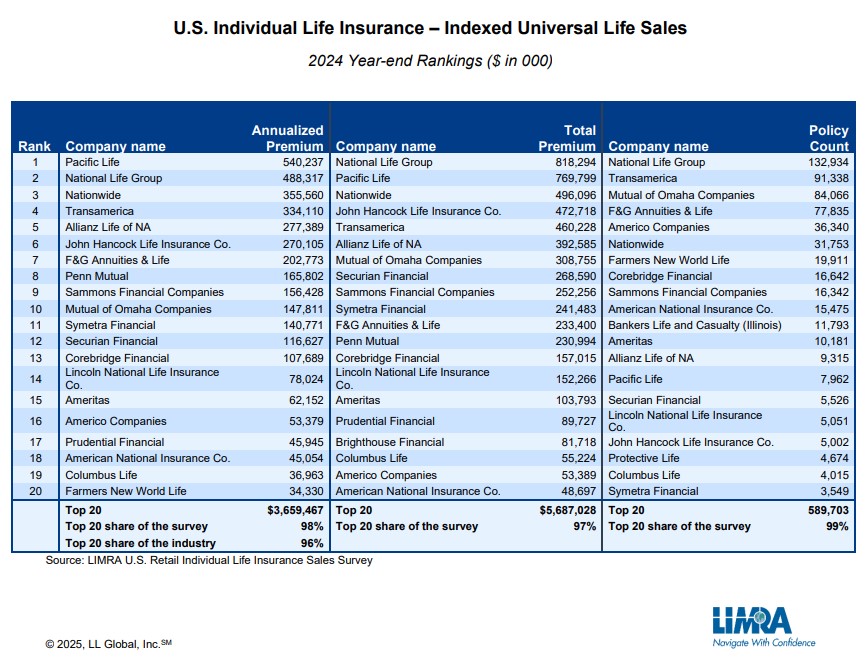

Indexed Universal Life (IUL) Leads the Charge

Indexed universal life (IUL) was a major driver of market expansion. New annualized premium for IUL reached a record $3.8 billion.

In the fourth quarter, IUL new premium climbed 10% to $1.15 billion. This surge was fueled by the introduction of updated product designs and broader distribution networks, with half of IUL carriers reporting gains. Moreover, policy count increased by 6% during the quarter.

“Independent distribution continues to drive the record sales in the U.S. market. This channel represented 6 in 10 dollars sold in 2024 — up from half of new premium sold just five years ago and represented over 90% of the record indexed universal life (IUL) sales in 2024,” said John Carroll, senior vice president and head of Life & Annuities, LIMRA and LOMA.

For the year, IUL new premium grew 4% compared to the previous year, reaching $3.8 billion. The number of policies grew by 10% year-over-year. IUL new premium now represents 24% of the total U.S. life insurance market.

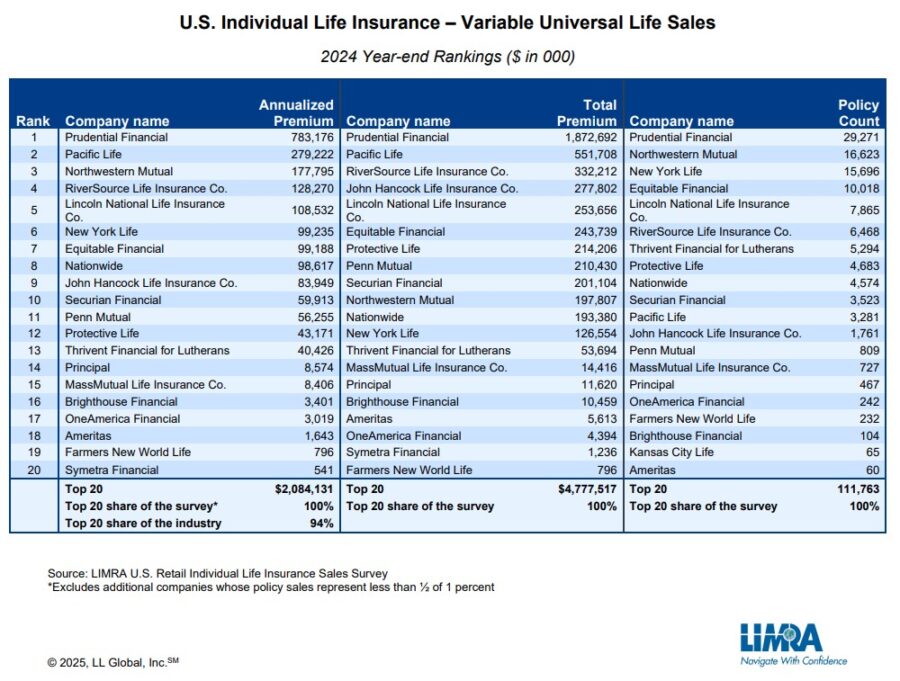

Variable Universal Life (VUL) Sees Strong Gains

Variable universal life (VUL) also demonstrated strong performance, with new premium rising 37% to $741 million in the fourth quarter. The number of policies sold in this segment increased by 10% during the same period. For the entire year, VUL new premium reached $2.2 billion, up 15% year-over-year. Similarly, policy count improved by 6%.

In 2024, VUL accounted for 14% of the total U.S. individual life insurance market.

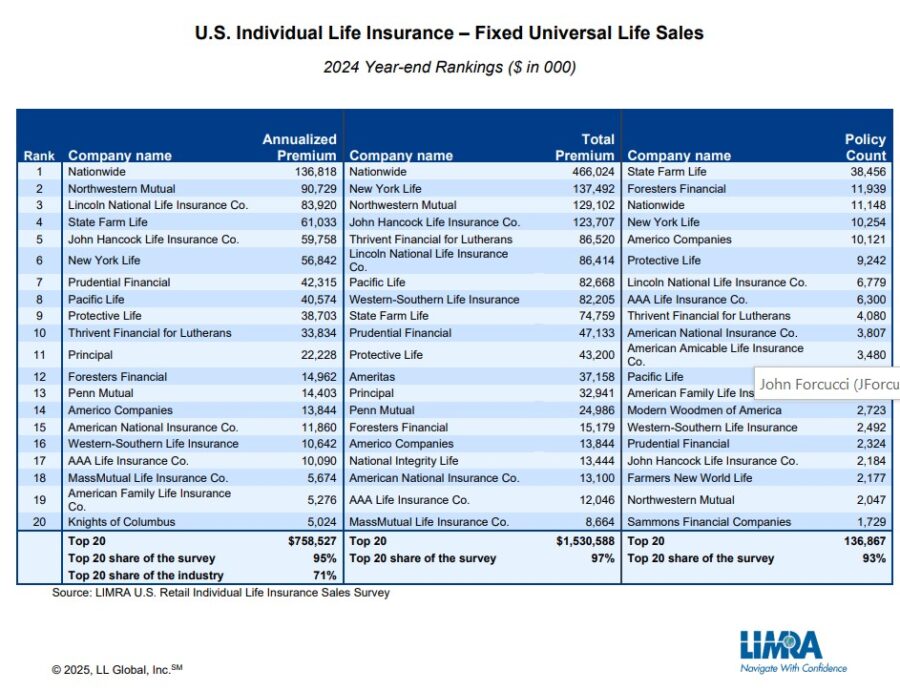

Other Product Lines

Fixed universal life (fixed UL) experienced a slight dip in the fourth quarter, with new premium declining 1% to $275 million. Policy count also fell by 13% compared to the fourth quarter of 2023. However, for the year, fixed UL saw a 7% increase in new premium, reaching $1.1 billion, although the policy count fell by 12%.

In 2024, fixed UL represented 7% of the U.S. life insurance market.

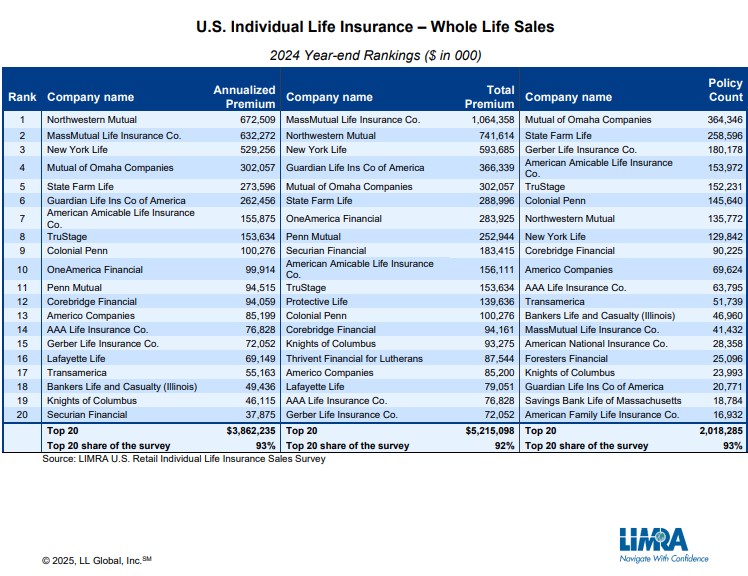

Whole life (WL) sales, after three consecutive quarters of decline, rebounded in the fourth quarter of 2024. New annualized premium totaled $1.6 billion, a 3% increase compared to the previous year. The number of WL policies sold increased by 3% during the quarter.

“Final expense and other smaller-face whole life policies drove the overall growth in the fourth quarter,” said Karen Terry, assistant vice president and head of LIMRA Insurance Product Research.

For the year, WL new premium fell by 4% to $5.8 billion, compared to 2023. At the same time, policy count decreased by 2% year-over-year. WL new premium represented 36% of the total life insurance market, marking its lowest market share since 2014.

Term life new premium totaled $749 million, which is a 1% decrease from the previous year. Policy count decreased 1% in the quarter as well. For the year, new premium reached over $3 billion, which is a 1% increase compared to 2023. The number of policies sold increased slightly by 1%. Term life new premium represented 19% of total sales in 2024.

Market Outlook

Total new premium in the fourth quarter rose 9% year-over-year to $4.5 billion. The number of policies sold increased by 1%, compared with fourth-quarter 2023 results. Overall, the life insurance market continued to show resilience as consumers seek solutions for long-term financial security in volatile markets.

LIMRA’s Retail Individual Life Insurance Sales Survey represents 80% of the U.S. life insurance market.