LifeLock vs NordProtect: Which Identity Theft Protection Service is Best?

When it comes to protecting your identity in 2025, LifeLock and NordProtect are two major players competing for the top spot. Both services offer powerful protection, including credit monitoring, dark web alerts, and identity restoration. However, key differences exist between them.

Core Features Comparison

-

LifeLock:

- Comprehensive identity theft protection

- Three-bureau credit monitoring in higher-tier plans

- Up to $3 million identity theft insurance

- Social media monitoring in top-tier plans

- Available across the US, including territories

-

NordProtect:

- Identity theft protection with a focus on restoration

- TransUnion credit monitoring

- Up to $1 million identity theft insurance

- Bundled with NordVPN, Threat Protection Pro, and Incogni

- Not available in New York or Washington

Key Differences

-

Credit Monitoring:

- LifeLock offers three-bureau monitoring in premium plans

- NordProtect monitors TransUnion only

-

Additional Features:

- NordProtect includes NordVPN, password manager, and Threat Protection Pro

- LifeLock offers Norton 360 integration for additional security

-

Pricing:

- NordProtect starts at $5.49/month

- LifeLock starts at $7.50/month

User Experience

-

Setup:

- Both services offer easy setup processes

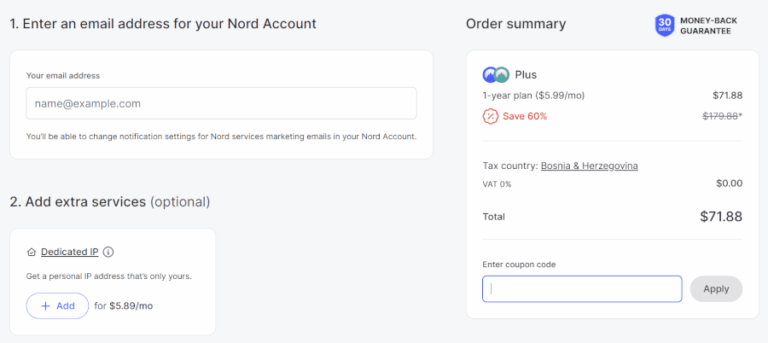

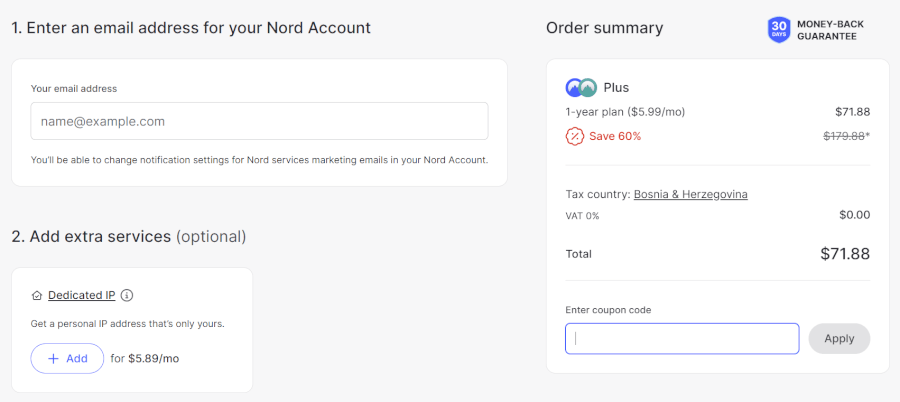

- NordProtect’s web-based interface is streamlined

- LifeLock has a traditional setup with more detailed information required

-

Dashboard:

- NordProtect’s dashboard is minimalistic and clear

- LifeLock’s interface is well-organized with quick access to features

Customer Support

-

LifeLock:

- 24/7 phone support

- Priority support for top-tier plans

-

NordProtect:

- Email support available

- Dedicated case managers for identity theft recovery

Pricing and Plans

LifeLock offers multiple plans with increasing features:

- Standard: $7.50/month (1-year plan)

- Advantage: $14.99/month (1-year plan)

- Ultimate Plus: $19.99/month (1-year plan)

NordProtect’s plans include additional security features:

- Silver: $5.49/month

- Gold: $8.49/month (includes NordVPN and Threat Protection Pro)

- Platinum: $11.99/month (includes NordVPN, Threat Protection Pro, and Incogni)

Conclusion

Both LifeLock and NordProtect offer robust identity theft protection, but they cater to different needs. LifeLock excels in comprehensive credit monitoring and financial protection, while NordProtect provides a complete digital security package with its bundled features. The best choice depends on your specific security requirements and whether you prefer a standalone identity protection service or an all-in-one security solution.

Additional Resources

For more information on identity theft protection and related services, check out these comparisons:

- Aura vs LifeLock

- IDShield vs Aura

- LifeLock vs IDShield

- Aura vs Incogni

Identity Theft Recovery Steps

If you become a victim of identity theft, follow these crucial steps:

- Contact affected companies and banks immediately

- Place fraud alerts with credit bureaus

- Freeze your credit reports

- Report to the FTC and local law enforcement

- Secure your online accounts with strong passwords and 2FA

By taking these actions, you can minimize damage and restore your identity effectively.