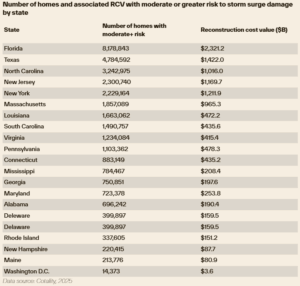

A recent report by Cotality, a property data provider formerly known as CoreLogic, has revealed that more than 33.1 million residential properties from Texas to Maine are at least at moderate risk of sustaining damage from hurricane-force winds. The combined reconstruction cost value of these properties stands at $11.7 trillion. Furthermore, 6.4 million residential properties with a reconstruction cost value of $2.2 trillion are at moderate or greater risk of damage from storm surge flooding.

“Our data shows that the coastline is evolving, with the impacts of hurricanes extending not only further—both in cost and distance—but also on a more consistent basis,” said Maiclaire Bolton-Smith, vice president of insurance product marketing at Cotality. “This is being reflected in insurance pricing, which in some cases can actually price people out of what had previously been thought of as less-risky markets.”

The Growing Risk and Its Consequences

As the risk of wind and flood damage grows, the availability and affordability of insurance in certain areas are creating what Cotality terms “liquidity traps.” Properties are losing value and staying on the real estate market longer. A study by the firm found that homes within the flood zone in Miami lost as much as 18% in value per square foot. However, from the buyer’s perspective, any savings are usually wiped out by the cost of insuring the property—if insurance can be found.

This dynamic is not limited to Florida, Louisiana, and Texas, where the hurricane risk is apparent and property insurance markets have experienced turmoil. Cotality has observed migration patterns indicating that people are moving to the Carolinas and other areas. However, this movement may stress infrastructure in areas thought to be safer from hurricane risk.

“Across the nation, floods caused by hurricanes routinely overwhelm infrastructure, knocking essential services like electricity, wastewater treatment, and clean drinking water offline for days or even weeks,” Cotality noted. The company also pointed out that some standards and funding programs from the Federal Emergency Management Agency (FEMA) were recently discontinued.

The growing hurricane risk is not only affecting property values and insurance costs but also influencing migration patterns and stressing infrastructure in areas considered safer. As the impacts of hurricanes continue to evolve, understanding these risks will be crucial for homeowners, insurers, and policymakers alike.