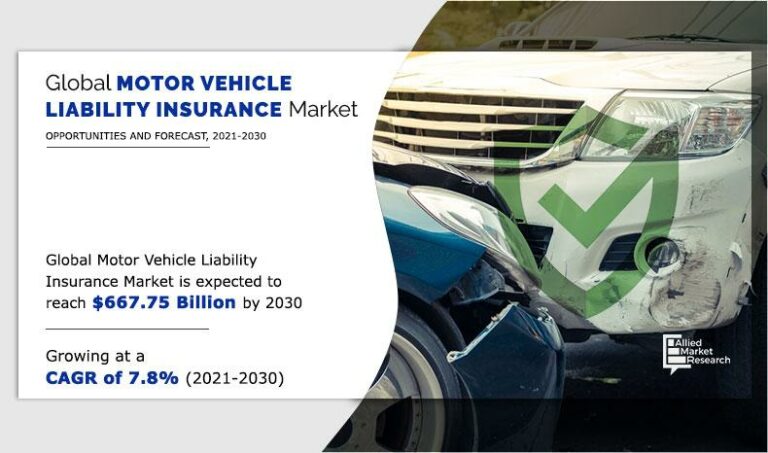

Motor Vehicle Liability Insurance Market Poised for Significant Growth

The global motor vehicle liability insurance market is on a steady growth trajectory. Valued at $297.00 billion in 2020, the market is projected to reach a substantial $667.75 billion by 2030, reflecting a compound annual growth rate (CAGR) of 7.8% from 2021 to 2030.

Motor vehicle liability insurance, often a compulsory component of standard car insurance policies in many countries, is designed to cover a driver’s legal responsibilities in the event of accidents. It offers protection for third-party bodily injury, death, and property damage. Additional comprehensive policies can also be added to this insurance.

Key Drivers of Market Growth

Several key factors are propelling the market forward:

- Mandatory Insurance and Low Costs: The widespread legal requirement for liability insurance, along with relatively affordable premiums, significantly boosts adoption.

- Government Regulations: Stringent government regulations mandating liability insurance are a major growth catalyst.

Market Challenges and Opportunities

Despite the positive outlook, the market faces certain constraints:

- Fraudulent Claims and Social Inflation: An increase in fraudulent claims and overall rises in costs may limit market expansion.

However, technological advancements offer new avenues for growth:

- Technological Integration: The adoption of big data, advanced analytics, and artificial intelligence is expected to present lucrative opportunities for expansion.

Segment Analysis

Vehicle Age

- New Vehicles: The new vehicle segment is expected to capture a significant share due to regulations requiring mandatory long-term insurance for new car owners.

- Used Vehicles: Anticipated to grow at the fastest rate, fueled by increased demand for older vehicles and cost-conscious consumers.

Regional Trends

- North America: Dominated the market in 2020, propelled by established economies in the U.S. and Canada and governmental road infrastructure investments.

- Asia-Pacific: Projected to show strong growth, especially in developing nations like China and India.

Impact of COVID-19

The COVID-19 pandemic has had a mixed impact:

- Negative Impacts: Travel restrictions decreased vehicle usage, which led to reduced premiums and sales, especially in the initial stages.

- Recovery Strategies: Key players adopted strategies to improve customer experience and regain market share.

Competitive Landscape

Key players in the motor vehicle liability insurance market include:

- Allstate

- AXA XL

- Chubb Limited

- Great American

- Hiscox Ltd.

- Nationwide

- Progressive Commercial

- State Farm

- The Hartford

- The Travelers Indemnity Company

These companies are focusing on strategic initiatives such as product launches, partnerships, and mergers & acquisitions to strengthen their market positions.

Conclusion

The motor vehicle liability insurance market is poised for considerable expansion over the next decade, driven by regulatory mandates, technological advancements, and evolving consumer needs. While challenges exist, the overall outlook remains positive, presenting opportunities for growth and innovation within the insurance sector.