The Unconventional Healthcare Stock to Watch

When it comes to healthcare stocks, investors often focus on established players like Eli Lilly, Novo Nordisk, CVS Health, and Johnson & Johnson. However, these companies haven’t seen significant stock price returns in 2025, with the exception of CVS, which has risen 46%. The pharmaceutical giants are facing pressure due to concerns about President Donald Trump’s administrative actions potentially impacting the industry, particularly regarding tariffs and medication pricing.

In contrast, telemedicine company Hims & Hers Health (HIMS) has seen its share price surge 138% in 2025 (as of June 17). While it might be tempting to jump on the Hims & Hers bandwagon, I believe a different, undervalued health insurance stock is poised for a breakout similar to Hims & Hers. That stock is Oscar Health (OSCR).

A Tech-First Approach to Health Insurance

Oscar Health is transforming access to health insurance with its tech-first digital platform. Unlike legacy insurers that have retrofitted outdated manual processes into technology platforms, Oscar is building its business model around technology. This approach is similar to Hims & Hers’ use of telemedicine services to streamline patient care.

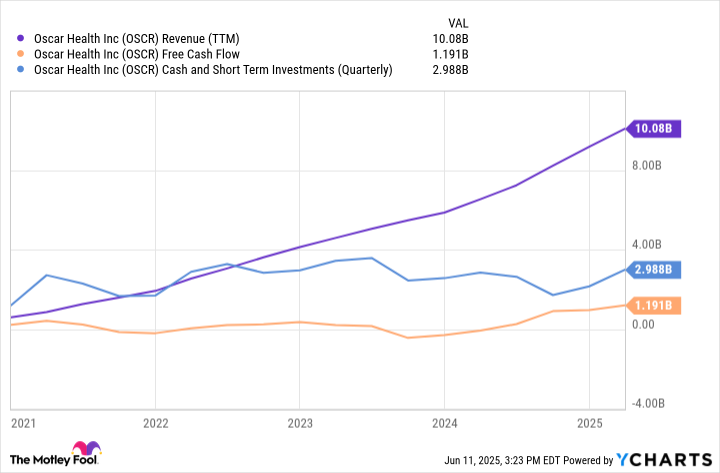

While Hims & Hers focuses on specific segments like mental health and weight management, Oscar has a niche focus on Affordable Care Act (ACA) members and small employers. Despite its niche focus, Oscar’s financial profile is robust, with a steepening revenue growth trajectory over the last five years, accompanied by rising cash flow and liquidity.

Expansion into New Markets

Oscar is working to diversify its revenue stream by expanding into related markets, such as individual coverage health reimbursement arrangements (ICHRAs) with small and medium-sized businesses (SMB). This move could increase its total addressable market (TAM) from $160 billion to $720 billion, opening up new growth opportunities.

Is Oscar Health Stock a Buy?

Despite its promising prospects, Oscar Health’s modest market capitalization of $4 billion is roughly in line with its cash balance, suggesting that Wall Street isn’t placing much value on the company’s insurance business. However, I believe the company’s long-term vision is compelling, and it has the potential to build a diversified healthcare platform like Hims & Hers.

While there are near-term headwinds, I’m cautiously optimistic that Oscar Health will see a sharp rise in its shares sooner than some may anticipate. With its tech-first approach, robust financial profile, and expansion into new markets, Oscar Health is a healthcare stock worth watching.