Other Health Insurance: Ensuring a Stronger Military Healthcare System

FORT WAINWRIGHT, Alaska – When visiting a military treatment facility, patients are often asked about “other health insurance” (OHI). While it may seem like a routine question, providing this information is crucial for both patients and the Military Health System. The practice helps ensure the effective distribution of healthcare costs and strengthens resources for those who serve.

By coordinating benefits with civilian employer plans or private insurance, the Military Health System can appropriately allocate costs. This helps ensure that the military healthcare system remains robust and capable of meeting the needs of service members, retirees, and their families.

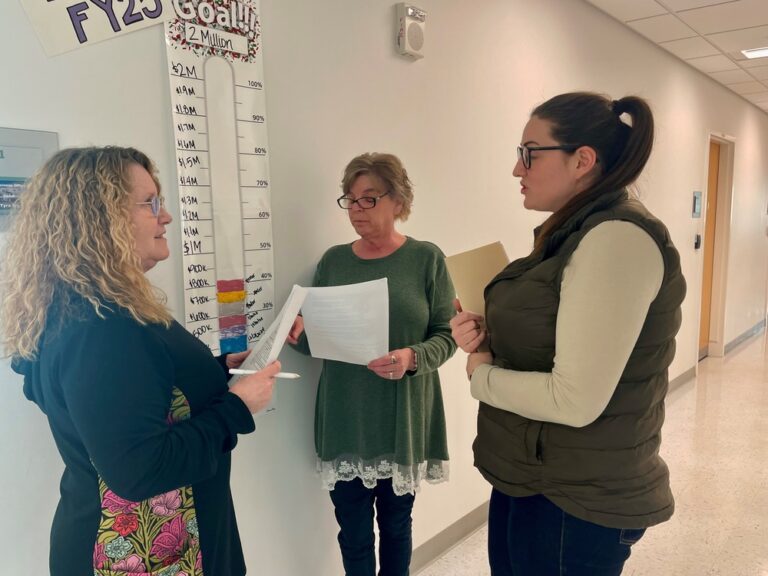

The Uniform Business Office (UBO) plays a vital role in this process by billing private insurance providers which helps recover funds that are then reinvested into patient care, facility improvements, and medical readiness.

In fiscal year 2024, the UBO team at Bassett Army Community Hospital alone recovered over $1.8 million, and they are on track to bring in approximately $2 million this year. This additional income strengthens local military healthcare.

“Money brought into MEDDAC-AK through OHI benefits Bassett and our outlying clinics across the state by putting that money back into our budget,” said Tyra Ivy, Chief of UBO at MEDDAC-AK. “Ultimately the income we bring in goes back into providing care to our patients.”

Benefits of Disclosing OHI

Disclosing OHI does not increase out-of-pocket expenses for patients. Instead, it facilitates private insurance’s share of medical costs, sustaining military healthcare resources. Using OHI can also lead to long-term savings for patients. “UBO does not bill TRICARE beneficiaries, and when they use their OHI, it helps them to meet their deductible, which may save them money, if they are referred off post,” Ivy explained.

Furthermore, providing accurate OHI information minimizes administrative delays and decreases the potential for out-of-pocket costs by preventing billing errors and claim denials. When providers have up-to-date insurance details, claims are processed correctly.

Your Role in Maintaining Accurate Records

To ensure the system operates efficiently, beneficiaries should:

- Provide their OHI information and VA Coverage at every visit.

- Report any changes in insurance coverage to the military treatment facility and TRICARE.

- If utilizing VA benefits, ensure authorization is complete and verify at check-in.

“Patients provide their OHI by filling out form DD2569 annually and updating the information when checking in for appointments,” Ivy said. “While it is an annual requirement, we encourage patients to let us know any time they have changes to their OHI.”

Working Together for a Stronger System

Sharing OHI helps support military healthcare operations, improve resources, and ensure fiscal responsibility within the system. The next time you check in for an appointment, take a moment to verify your insurance details. It’s a small step that makes a big impact—for you, for the military community, and for the future of military medicine.

For more information on TRICARE and OHI, visit www.tricare.mil.