Pet Insurance: A Growing Trend in Pet Care

*Lily Fortin with her poodle mix Scupper.

Pet insurance has taken off. As both pet ownership and veterinary costs increase, more and more people are considering protecting their furry family members. One person who has seen it firsthand is Lily Fortin, a liaison at Back Cove Animal Hospital in Portland. She has invested a lot of time, energy, and money into caring for her two poodle mixes, Scupper and Minnie. They’ve faced various health challenges, including neurologic issues, seizures, allergies, and back pain, resulting in about $23,000 in vet bills in the past few years. Thanks to pet insurance, Fortin has only paid about $2,500 out-of-pocket.

Several companies provide pet health insurance, reporting substantial annual growth. Also, many employers are adding pet insurance to voluntary benefits packages. While these companies don’t typically contribute to premium costs, group rates can be lower than individual policies. One example of this is at Maine Veterinary Medical Center, which subsidizes pet insurance for its employees.

The veterinary industry is a strong advocate for pet insurance, deeming it a worthwhile investment. On the other hand, some pet owners are concerned about rising premium costs and coverage limitations for preexisting conditions. Fortin sees the benefits of pet insurance for the financial strain it removes from decisions about caring for sick or injured pets, because it allows her to make decisions based on the best medical options.

*Lily Fortin and her dog Scupper.

The National Pet Health Insurance Association reported that nearly 6.3 million pets across the U.S. and Canada had insurance last year, a rough 21% growth from 2022. The North American pet insurance business generated over $4 billion in premiums in 2023, almost a 22% increase from the $3.5 billion generated in 2022.

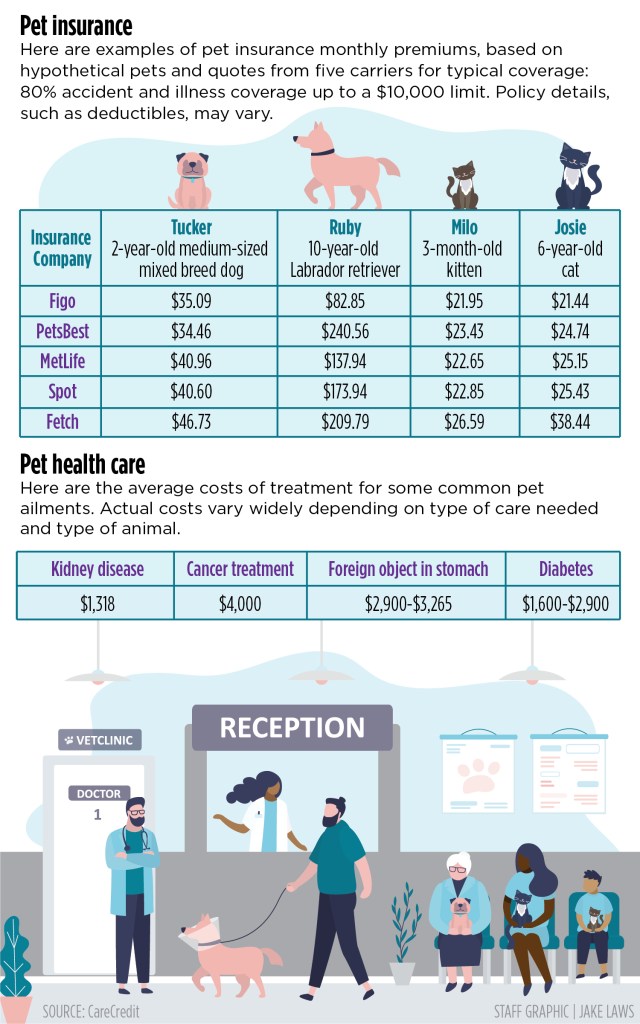

Quoting a $10,000 policy with 80% reimbursement for four hypothetical pets, premiums may vary. For example, dog premiums can range from around $34 to $240 per month, depending on their age. For cats, premiums ranged from about $22 to $38 per month. Trupanion, a key player in Maine, has generally higher premiums however, plans include unlimited coverage and no deductibles. They pay vets directly, providing a different approach than reimbursement-based policies.

Pet Insurance as an Employee Benefit

Pet insurance is gaining popularity as an employee benefit because companies seek to recruit and keep workers in a competitive environment. According to Mercer, an HR research firm, roughly 36% of companies with over 500 employees offer pet insurance across the nation. Unum is among the latest to join the pet insurance market, offering it to its employees in Maine and elsewhere, and other employers. After an employee’s Siberian husky mix ate a pillow, Unum staff realized the practical need for insurance. This experience led to a $400 vet bill due to the incident.

MEMIC has offered pet insurance as part of its voluntary benefits package since 2018. While it may not be the highest priority for employees, offering pet insurance can be an effective way of attracting potential hires and retaining current ones. Some surveys show that it is the number one requested benefit by Gen Z and millennial workers. However, despite the prevalence of pet insurance, some HR consultants aren’t seeing that trend in Maine yet.

Financial Implications

Higher costs of modern treatment for sick pets can be financially overwhelming for those without insurance or savings. In 2022, Maine Veterinary Medical Center in Scarborough received harsh communications after a viral news story about an owner who could not afford the $10,000 bill for surgery of their puppy. The puppy then was placed with a family that had the financial resources to pay for surgery. The hospital tries to be transparent about costs, and they also have systems in place to ease the financial burden. Initial evaluations at an emergency vet can cost approximately $150 to $250. Additional tests, medications, treatments, and surgery can easily exceed $10,000.

About 17% of new MVMC patients have pet insurance, and this number has been on the rise. The cost of veterinary services has skyrocketed by almost 60% in the past decade, and costs increased significantly between April 2023 and April 2024. Maine is among the most expensive states for veterinary care, with a routine visit costing an average of $81.

Dr. Ezra Steinberg, a staff surgeon at MVMC, knows firsthand about the importance of insurance. In 2022, his dog Sawyer was diagnosed with skin cancer. After a ruptured tumor, Steinberg was looking at a $45,000 invoice. His insurance covered all but $4,500, and he stated that he felt he got an extra year because of the insurance.

Considerations and Costs

*Pet Insurance Sign.

Despite the benefits, not everyone is content with their pet insurance, as some are complaining about price hikes. Some policies may not cover certain conditions, while others are concerned about what insurance companies consider a pre-existing condition, denying coverage due to the belief that the condition was present before the pet was insured. Some owners are now considering canceling their coverage because of premium increases.

Heather Sanborn, co-owner of Rising Tide Brewing Co. in Portland, has experienced a doubling of her premiums in the last few years. Sanborn believes it’s still worth the cost. She got policies for both of her dogs while they were still puppies. Calypso, 11, has been on arthritis medication for three years, and Trupanion pays 90% of the cost.

The state of Maine passed a new law clarifying pet insurance regulations. Matt Fortin, co-owner of Back Cove Animal Hospital, frequently addresses client questions about the value of pet insurance. He typically advises that it is a personal financial decision. The question boils down to whether you have the resources to cover a $10,000 to $15,000 emergency vet bill. If not, pet insurance can be a solid option. Ultimately, pet insurance companies make their money because they collect more in premiums compared to what they pay out in benefits. Getting insurance is a gamble, but it can make the difference in whether a pet receives life-saving care.