Samsung C&T and Samsung Life Insurance shares have been fluctuating since Samsung Biologics announced on May 22nd that it would create a new company called Samsung Epis Holdings (tentative name). This move is part of Samsung Group’s governance restructuring efforts.

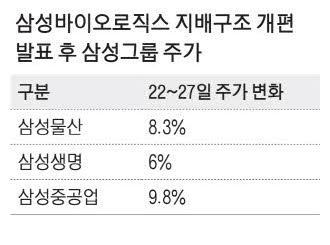

On the KOSPI on May 27th, Samsung C&T shares closed at 150,500 won, an 8.3% increase over four trading days following the announcement. Samsung C&T holds a 43.1% stake in Samsung Biologics. Lee Sang-hun, a researcher at iM Securities, noted that the value of Samsung Bioepis, which runs R&D business, has been indirectly reflected in Samsung C&T through Samsung Biologics. He added that this governance reform will allow for a more direct reflection of the value of new drug R&D businesses, which are high value-added industries.

Macquarie Securities raised its target price for Samsung C&T to 200,000 won from 150,000 won. As Samsung C&T has a way to cash in its bio business, it has reduced its holding company discount from 60% to 40%. Samsung Life Insurance, which has a 19.3% stake in Samsung C&T, has also seen its stock price rise due to expectations that the governance restructuring will proceed in its favor.

Attention is focusing on how Samsung Electronics’ stake will be handled in the group governance structure, which includes Chairman Lee Jae-yong, Samsung C&T, Samsung Life Insurance, and Samsung Electronics. The National Assembly is pending an amendment to the insurance industry law called the ‘Samsung Life Act.’ If passed, insurers must evaluate their shares in affiliates at market prices, not acquisition costs. Samsung Life Insurance’s current stake in Samsung Electronics is valued at 27 trillion won, so they would have to sell 19 trillion won worth of shares.

One scenario is that Samsung C&T will buy Samsung Electronics shares that Samsung Life Insurance has to sell, potentially using funds from selling its stake in Samsung Epis Holdings. Samsung Life Insurance can then use the financial resources generated by selling its Samsung Electronics stake to return value to shareholders. Jeon Bae-seung, a researcher at LS Securities, estimated that about half of the proceeds from the sale can be used to finance shareholder dividends.

Shares of Samsung Heavy Industries jumped 8.28% on the same day. Samsung Heavy Industries holds 15.23% of Samsung Electronics and 2.92% of Samsung Life Insurance. There’s a possibility that Samsung Electronics could exchange its stake in Samsung Heavy Industries with Samsung Life Insurance, increasing Samsung Electronics’ share ratio and strengthening its control.