Samsung Life Insurance: Understanding the Ownership Dynamics

This analysis examines the ownership structure of Samsung Life Insurance Co., Ltd. (KRX:032830), providing insights into the influence of various shareholder groups on the company’s stock performance.

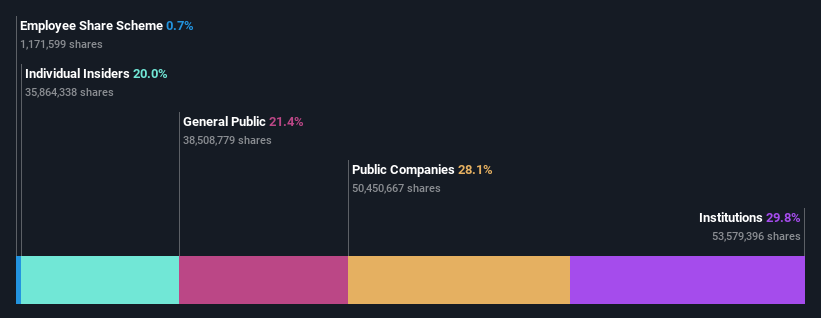

Institutional Ownership

Institutions hold a significant stake in Samsung Life Insurance, with approximately 30% of the company’s shares. Institutional investors often wield considerable influence due to their substantial resources and trading activity. Consequently, their investment decisions often reflect a strong vote of confidence in the company’s future. However, investors should remain cautious, as even institutional investors can misjudge a stock’s trajectory. Significant shifts in institutional sentiment can lead to rapid changes in share price.

Key Shareholders

Samsung C&T Corporation is the largest shareholder, owning about 22% of the outstanding shares. The second-largest shareholder is Jae-Yong Lee with 12% of the common stock. The National Pension Service holds roughly 7.6% of the company’s stock. Furthermore, the top five shareholders collectively control 54% of the shares, giving them considerable influence over company decisions.

Insider Ownership

Insiders, including board members, own a considerable portion of the company. In the case of Samsung Life Insurance, insiders hold a significant portion of the company’s market capitalization, with approximately ₩3.0t worth of shares. This level of insider ownership suggests that the board is aligned with other shareholders’ interests. However, it is worth noting the potential for over-concentration of power within this group.

General Public Ownership

The general public, comprised primarily of individual investors, holds a 21% stake in Samsung Life Insurance. While this group might not have direct control, their collective actions can influence the company’s performance.

Public Company Ownership

Public companies hold 28% of the Samsung Life Insurance shares. This suggests interconnected business interests. This type of ownership structure warrants close observation, as it could reflect a strategic long-term investment.

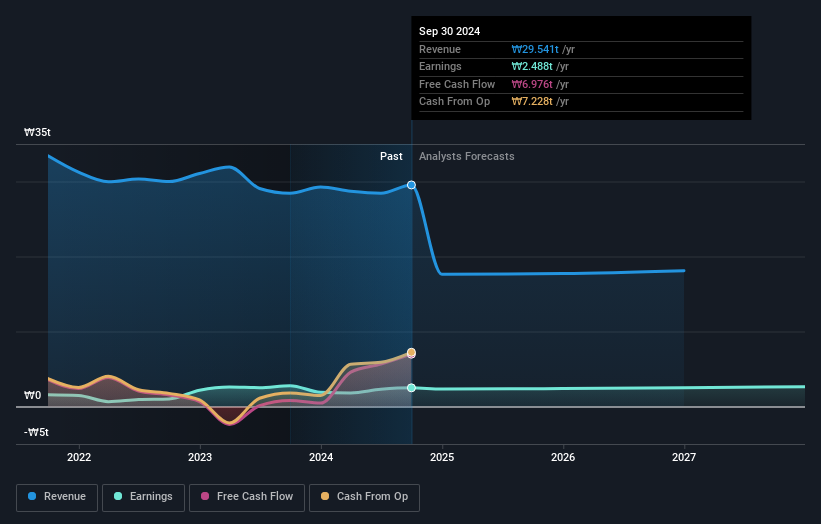

Analyst Perspectives

It’s essential to monitor analyst opinions on the stock given the reasonable number of analysts covering it. Their outlook can provide useful insights into the future performance of the stock.

Conclusion

Understanding the ownership structure of Samsung Life Insurance provides valuable perspective for investors. By examining the influence of institutional investors, insiders, public company ownership, and the general public, stakeholders can gain a more comprehensive view of the company’s potential and the factors that may impact its performance.