SBI Life Insurance Company Limited’s (SBILIFE) Stock: A Deeper Dive into Financials

SBI Life Insurance (NSE:SBILIFE) has seen a significant surge in its stock price, increasing by 12% over the past week. This raises the question: Is this momentum supported by the company’s financial fundamentals? This analysis delves into SBI Life Insurance’s financials, specifically focusing on Return on Equity (ROE) to assess the sustainability of this recent performance.

Return on Equity: A Key Indicator

Return on Equity, or ROE, is a crucial metric for investors as it reveals how effectively a company is reinvesting shareholder capital to generate profits. It essentially measures the company’s ability to convert investments into earnings.

ROE is calculated using the following formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Based on the trailing twelve months ending December 2024, SBI Life Insurance’s ROE was 15%, calculated as ₹24 billion in net profit divided by ₹166 billion in shareholders’ equity. This suggests that for every ₹1 of shareholder capital, the company generated ₹0.15 in profit.

ROE and Earnings Growth: The Connection

Companies with both a high ROE and a high profit retention rate often exhibit higher growth rates. This is because they efficiently reinvest earnings back into the business.

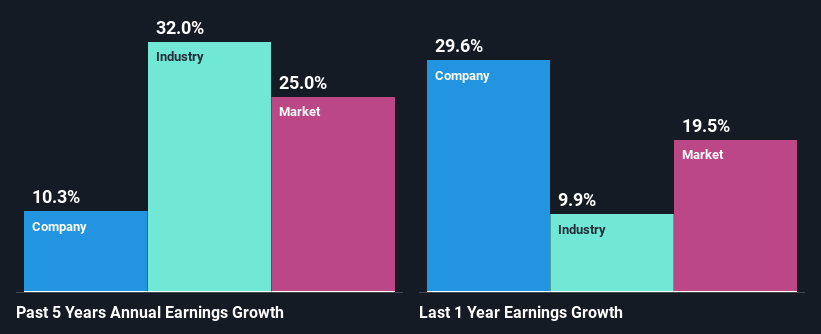

SBI Life Insurance’s ROE of 15% appears modest at first glance. However, it’s notably higher than the industry average of 8.3%. This context is relevant to the company’s moderate 10% net income growth observed over the past five years. While the ROE is still a factor, the industry average is a consideration.

Comparing SBI Life Insurance’s net income growth to the industry average of 32% during the same period reveals that SBI Life’s growth lagged the industry’s. Other factors, such as a low payout ratio or the company belonging to a high-growth industry, may also affect its expansion.

Assessing the Impact of Earnings Growth

Earnings growth is a vital factor in stock valuation. Investors analyze whether anticipated earnings changes are reflected in the stock price to gauge its future potential. The P/E ratio, which assesses the market’s willingness to pay for a stock based on its earnings prospects, can offer insight into this.

Efficient Use of Retained Earnings

SBI Life Insurance has a low three-year median payout ratio of 15%, retaining 85% of its profits. This indicates that management is predominantly reinvesting earnings to fuel business expansion. The company has consistently paid dividends over the past seven years, highlighting its commitment to shareholder returns.

Analysts predict that the payout ratio will remain stable at 14% in the coming three years, with the future ROE expected to align with the 13% forecast.

Conclusion

SBI Life Insurance presents some positive attributes. The company reinvests a substantial portion of its profits at a respectable rate of return, which in turn has driven earnings growth. Industry analysts anticipate continued growth at the current pace.