Texas Homeowners Face Steep Rise in Insurance Costs

Peter and Alice Kochunov, after relocating from Maryland to Pearland in 2023, were shocked by their home insurance bill, which was ten times higher than their previous policy. This prompted them to avoid filing a claim after Hurricane Beryl caused over $15,000 in damage last July, fearing policy non-renewal, Peter Kochunov said.

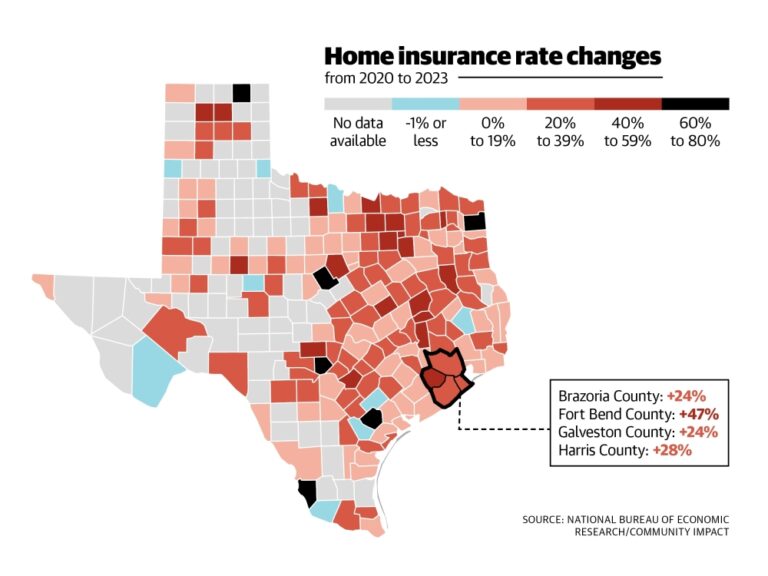

Texas consistently ranks among the states with the steepest home insurance premiums, according to the National Bureau of Economic Research. The rising costs are causing residents to consider going without insurance, while some insurance companies are exiting the market altogether.

The Regulatory Landscape

Since 2003, Texas has operated under a ‘file-and-use’ system for home insurance, which allows insurance companies to raise rates without prior state approval, provided they notify the Texas Department of Insurance (TDI). Ware Wendell, executive director of Texas Watch, an organization that monitors insurance practices, described this as a system of “drive-by-filings.”

“They could just slide an envelope across the desk at [Texas Department of Insurance] and tell them, ‘This is what we’re charging,’ and then put that into practice immediately,” he said. Wendell emphasized the TDI’s responsibility to contest rate hikes that violate state law. Despite reviewing over 2,300 rate filings in 2024, the TDI disapproved none.

Rising Premiums and Contributing Factors

Between 2022 and 2023, Texas saw a 23% increase in insurance premiums, the highest in the nation during that period, compared to a national average increase of 11%, according to S&P Global. John Cobarruvias, a consumer advocate and homeowner, points to rising contractor costs as a significant driver of increased insurance expenses.

“The roofing company charges that large amount, the insurance company pays that large amount and then we get charged for it in their premiums,” he said. The rising costs of home repairs, including roofs and other structural elements, elevate insurance costs by extension.

Legislative Efforts and Alternative Solutions

The state legislature is currently considering several bills aimed at addressing the issue. House Bill 2067, proposed by Rep. Dennis Paul, R-Clear Lake, would mandate insurance companies to provide reasons for policy denials, cancellations, or non-renewals. Another route for aid is offered by the Texas Windstorm Insurance Association (TWIA), a state-sponsored provider for homeowners unable to secure coverage from private insurers.

The number of TWIA policies in Brazoria and Galveston counties has increased by at least 36% since 2019, according to TWIA data.

Market Dynamics and Challenges for Insurers

As of 2025, 160 companies offer homeowners insurance in Texas, a number that has remained stable since 2022, representing a 20% increase over the past decade, the TDI reports. In 2023, insurance companies sold over 8.7 million policies in Texas, a 35% increase from 2013. Despite this, several insurance companies are facing challenges.

In 2022, USAA, a San Antonio-based insurer, reported its first loss in its 102-year history. Other insurance companies are restricting their policy offerings in Texas. “Our advice to consumers is to keep shopping,” said TDI Communications Specialist Ben Gonzalez in an email.

Jessica Marsh-Jarl, a Sagemont resident and homeowner for over twenty years, is closely monitoring the rate increases. “If something doesn’t change, we’re going to have a ton of homes going into foreclosure and either restructuring of loans or people being on the street, because you’ve got a lot of people on fixed incomes that can’t afford these [changes],”

Factors Influencing Insurance Costs

Insurance companies cite risks such as natural disasters and the lingering impacts of the COVID-19 pandemic on construction costs as contributing to their challenges. Stephanie Montiel, a Pearland resident and insurance broker at TWFG Insurance, referenced Hurricane Beryl, which caused billions of dollars in damage, and Winter Storm Uri in 2021, as factors pushing premiums upward.

This results in more non-renewals, Montiel said. Senate reports confirmed higher non-renewal rates in counties with higher climate-related risks such as coastal areas. Brazoria and Galveston counties fall into this category.

Proposed Solutions and Future Outlook

Rep. Paul hopes HB 2067 will provide accountability and aid the state in understanding why companies are dropping customers. While some, like Cobarruvias, are skeptical that this approach will curb rate hikes, Paul believes the state is limited in its direct intervention.

Paul believes that incentivizing competition can introduce more companies, thereby spreading out the risk and potentially lowering rates. He warned that government-set rates or limits on rate increases could cause companies to withdraw. “Having government interference come in and set a rate is a total disaster,” he said. Separately, Rep. Tom Oliverson, R-Cypress has proposed HB 1576, which would establish a grant program for hurricane and windstorm loss mitigation for single-family residential properties.

Following Hurricane Beryl, TWIA sought a 10% rate increase, but the TDI blocked it, according to TWIA’s website. TWIA officials mentioned in a December report that claims from Beryl could deplete the organization’s $450 million trust fund. Cobarruvias voiced concern about TWIA as the potential only option for coverage. “That was supposed to be the insurance of last resort,” he said.

Paul also suggested options for lowering rates, including incentives for fortified home upgrades and considering group insurance options.