The South Korean government is introducing a new system that will allow life insurance policyholders over the age of 65 to utilize their death insurance benefits to fund pensions or cover medical care costs during their lifetime. This initiative, expected to be implemented as early as the third quarter of this year, addresses the increasing number of single-person households and aims to provide a more secure retirement for citizens.

On March 11, the Financial Services Commission and the Financial Supervisory Service announced their plan to securitize death insurance premiums. The objective is to allow policyholders, much like using the equity in their home as a pension, to access some of the death benefit funds, which would otherwise be left to heirs, to cover retirement expenses. The system aims to provide retirees with more money than the total premiums paid while still leaving some death benefit for beneficiaries.

Specifically, contractors with fixed-rate life insurance policies who are 65 years of age or older, and who have held their policies for more than ten years and paid premiums for at least five years, will be eligible to securitize up to 90% of their death insurance payments. These funds can then be received either as monthly pensions or used for services such as medical care and health services. However, policyholders with insurance contract loans, or those with death insurance payouts exceeding 900 million won (approximately $675,000 USD), will be excluded from the program.

Financial authorities anticipate that the majority of those who subscribed to interest rate-settled life insurance policies between the mid-1990s and the early 2010s will be included in the program, assuming they have no existing insurance contract loans. Policyholders will have two liquidity options: a pension type or a service type.

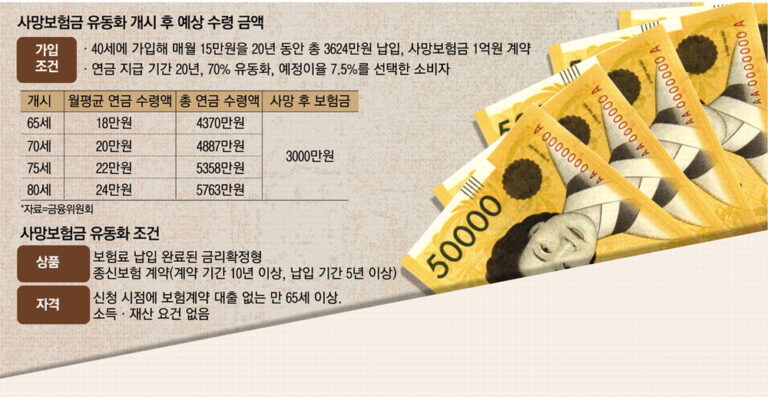

The pension type allows for a monthly pension payment that exceeds the monthly premium paid, potentially offering from 100% to 200% of the original premium. For instance, consider a consumer who took out death insurance at age 40, paid a total of 36.24 million won (approximately $27,180 USD) over 20 years, with a monthly premium of 151,000 won (approximately $113 USD), and has a death insurance benefit of 100 million won (approximately $75,000 USD). If this consumer liquidates 70% of their insurance money and chooses a 20-year payment plan, they would receive 180,000 won (approximately $135 USD) monthly from age 65. If the payment starts at age 80, the monthly pension would be 240,000 won (approximately $180 USD). The remaining 30% (30 million won or approximately $22,500 USD) of the original death benefit would still be paid to the heir.

While the exact monthly amount varies based on the securitization ratio and the age at which payments begin, the retiree is guaranteed to receive more than their original monthly insurance premium as a pension. Alternatively, policyholders can use their death insurance benefits to fund age-related services. For example, a consumer could securitize their death insurance to partially cover the costs of a B care facility affiliated with insurance company A, or to pay for a dedicated nurse or other medical services such as medication and dietary counseling. The financial authorities plan to release securitization products from various insurance companies sequentially, starting as early as the third quarter of this year.