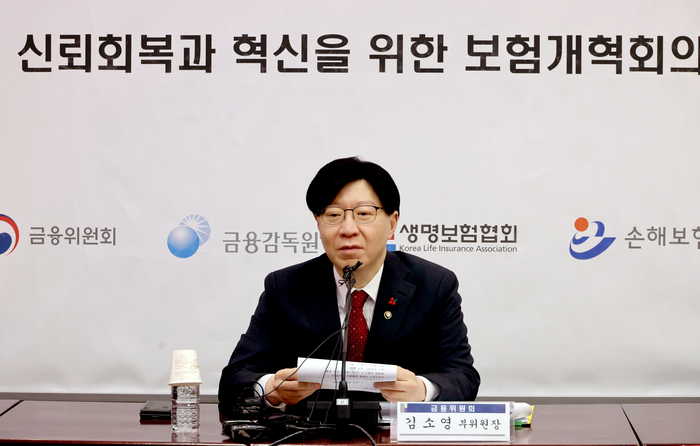

The Financial Services Commission (FSC) is driving significant reforms within South Korea’s insurance industry, aiming to foster innovation and adapt to evolving societal needs. The FSC has outlined plans to allow insurance companies to expand into new business areas, including healthcare, senior care, and even companion animal services. This strategic shift is designed to address the challenges posed by a rapidly aging population and embrace technological advancements.