Strategically Insuring Your Farm: Exploring Micro-Captive Insurance

Over the last quarter-century, agricultural producers have become well-versed in the nuances of modern crop insurance. The dynamics of the insurance market, encompassing crops, property, and casualty, have shifted considerably in recent years. In particular, crop insurance premiums per acre have increased, and the available contract options have become more complex. Concurrently, property and casualty insurance has seen a rise in claim costs, leading to higher premiums, increased deductibles, and, in some cases, reduced coverage.

Given this landscape of increased insurance market complexity, rising premiums, expanding deductibles, and the potential for coverage denial, it’s an opportune time to consider an alternative insurance approach: Section 831(b) of the U.S. tax law, often referred to as “micro-captives.”

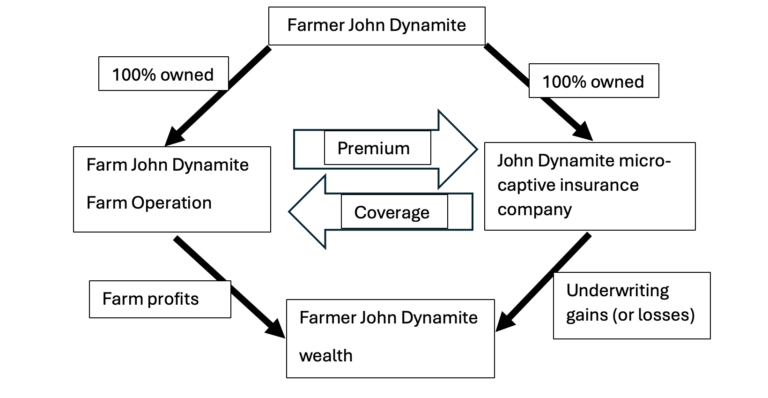

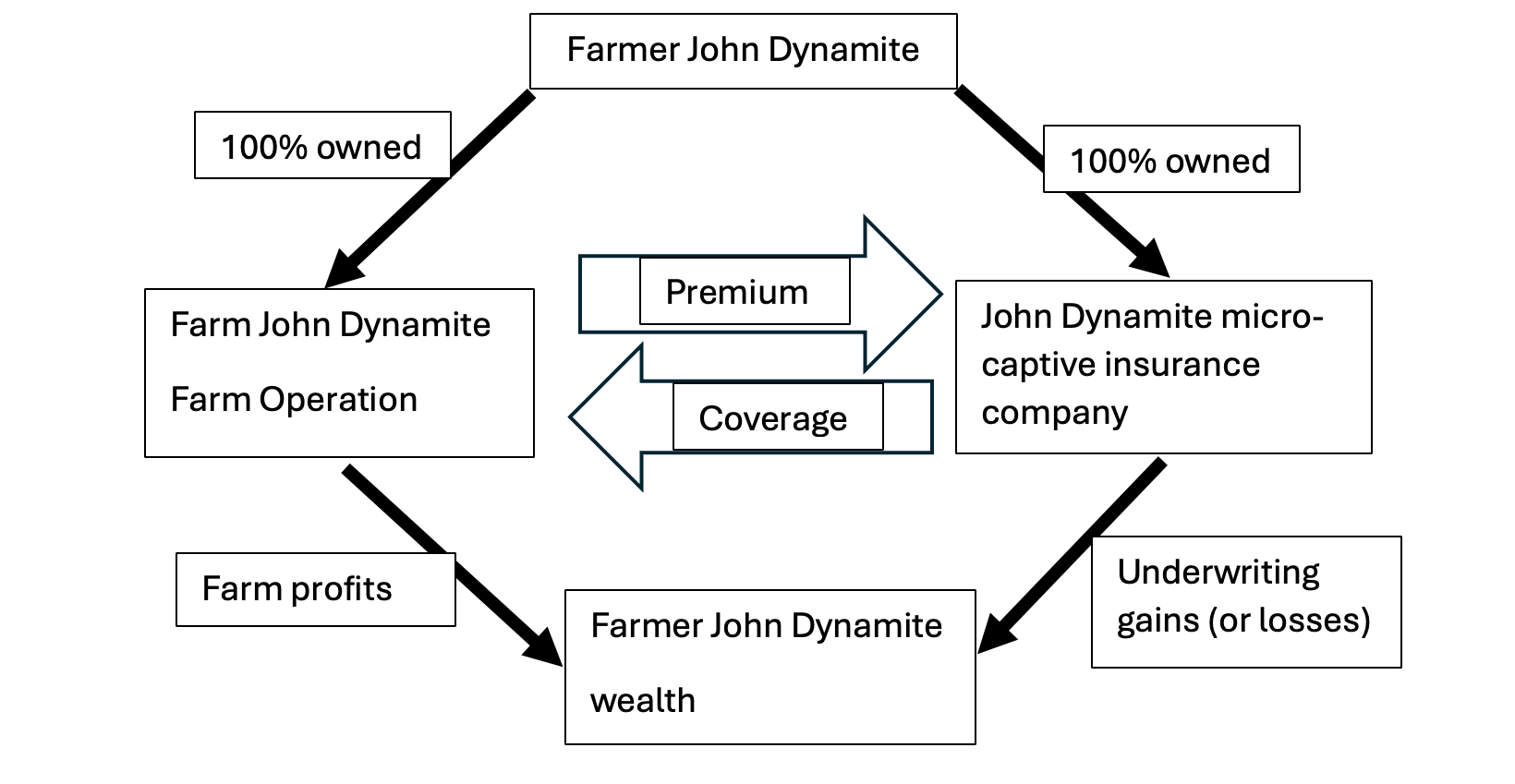

A micro-captive functions as an insurance company wholly owned and operated by the insured. This structure allows micro-captives to pay taxes solely on investment income, exempting underwriting gains (the difference between earned premiums and indemnities) from federal income tax. These micro-captives have existed for about 40 years, with some tax code reforms aimed at modernization.

Micro-captives can offer considerable long-term benefits to farm businesses:

- Insuring specific farm business risks

- Managing costs associated with potentially overpriced or poorly designed commercial insurance

- Generating financial gains through underwriting profits

- Allowing for untaxed premiums accumulation of untaxed underwriting gains

Micro-captives also present risks and expenses that must be understood and carefully evaluated. Initial expenses involve establishing the insurance company, as well as ongoing yearly administrative costs. Efficiency in administrative costs often increases as farms scale up and micro-captive usage grows.

Owning a micro-captive carries inherent risks for the owner’s capital, particularly in the initial years, but effective long-run risk managers can balance the risk/reward to yield future profits. The following are some strategies producers have employed.

Micro-Captive Strategy Examples

A micro-captive should not replace the farm’s primary insurance policies. A producer might have a Multi-Peril Crop Insurance (MPCI) Revenue Protection (RP) policy with a 70% coverage level. If the producer believes that the premiums for higher coverage levels or county-based policies (such as SCO/ECO) are overpriced, they could form a micro-captive to provide coverage from 70% up to, for example, 91%. The initial MPCI-RP policy remains in place.

Through a captive manager, premiums for this policy are determined using MPCI methods, thus ensuring actuarial soundness. The producer then writes a premium check to their micro-captive in exchange for coverage extending from 70% to 91% of expected revenue.

Consider a harvest scenario. There are two possible outcomes: either a claim occurs, or it does not. Suppose that yields and prices remained stable, resulting in no claims. In this case, the premiums remain in the micro-captive, minus any administrative costs. The micro-captive then possesses underwriting gains that can be managed strategically. Imagine instead that yields and/or prices declined, leading to an insurance claim. Supposing that the loss surpasses the 30% crop insurance deductible, the producer would receive an indemnity from their crop insurance contract up to the guaranteed amount. The farm can then submit a claim to their micro-captive insurance company, which will then issue a check to the farm for the claim.

Some challenges can arise when starting a captive due to the potential for insufficient funds to cover claims in the first couple of years. However, insurance often does not pay out claims in many years, thus leading to underwriting gains. Another example would be center pivot insurance.

Many other examples exist and illustrate the utility of micro-captive coverage that is tailored to meet specific risks. However, all micro-captive rules must be strictly followed. Managing a micro-captive introduces added complexity to farm financial management. Before getting involved with micro-captives, it’s essential to understand how to manage them, stay current on micro-captive tax code changes, assess your financial situation, and develop an exit strategy from the micro-captive approach, which would be years down the road.

With today’s agricultural environment and what the future holds, opportunities for farm financial management may arise through strategic utilization of micro-captives.