Taiwan Approves Amendment to Protect Insurance Policies from Debt Seizures

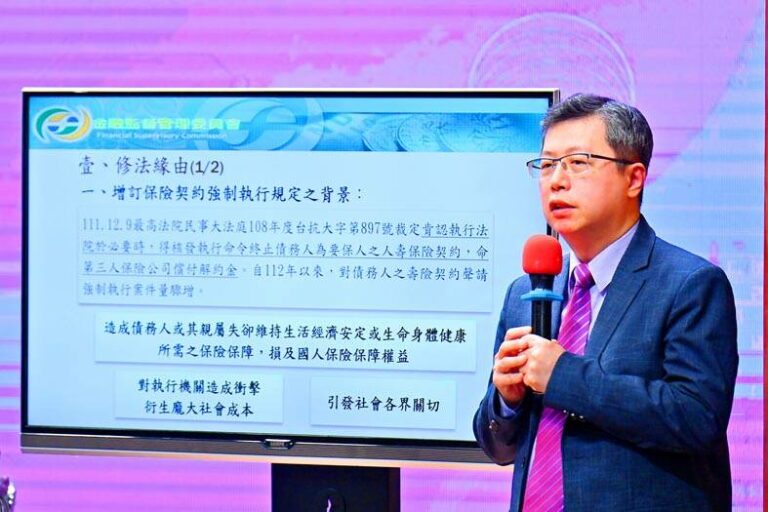

TAIPEI – The Cabinet approved an amendment to the Insurance Act (保險法) on Thursday, March 13, 2025, designed to prevent courts from seizing the life insurance policies of individuals burdened by debt.

The amendment establishes that if the payout value of a life insurance policy or other eligible policies falls below 1.2 times the minimum monthly living wage for three consecutive months, the policy is protected from seizure or termination.

Insurance Bureau Deputy Director-General Tsai Huo-yen provided specific figures detailing the threshold amounts. Those amounts are:

- NT$73,365 in Taipei

- NT$60,840 in New Taipei City

- NT$60,366 in Taoyuan

- NT$57,744 in Kaohsiung

- NT$55,854 in Tainan

- NT$57,876 in Taichung

- NT$51,627 in Kinmen and Lienchiang counties

- NT$55,854 for all other cities and counties

Tsai highlighted the scope of the problem, noting that the government ordered the termination of 928,000 insurance policies between January 2023 and September 2024. This increase followed a 2022 Supreme Court ruling, which referenced a 2019 precedent, affirming the courts’ authority to order insurance companies to terminate the life insurance policies of indebted individuals.

He explained that 30 percent of the terminated policies were life insurance, while the remaining 70 percent comprised casualty or health insurance.

While the Supreme Court ruling specifically addressed life insurance, other types of policies, including health and those with low termination payouts, were also affected, Tsai said.

He elaborated on the adverse effects of these terminations, which, while aiding in debt repayment, also deprived individuals of crucial medical insurance coverage. Furthermore, the process of terminating the policies to repay outstanding debts consumed a significant amount of time and personnel resources.

Tsai stated that approximately 46,000 policies had been terminated, significantly diminishing the protections individuals had established for themselves.