The Impact of Climate Change on Insurance Costs

Climate change is no longer just an environmental issue; it’s also an economic one, particularly in the insurance industry. As wildfires, hurricanes, and other disasters grow in severity and frequency, insurers are rethinking their business models. The result is higher premiums and reduced coverage options for homeowners.

Rising Costs of Home Insurance

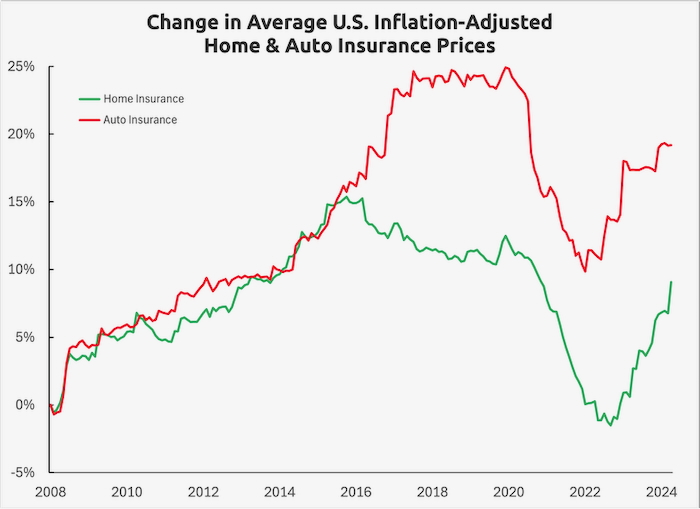

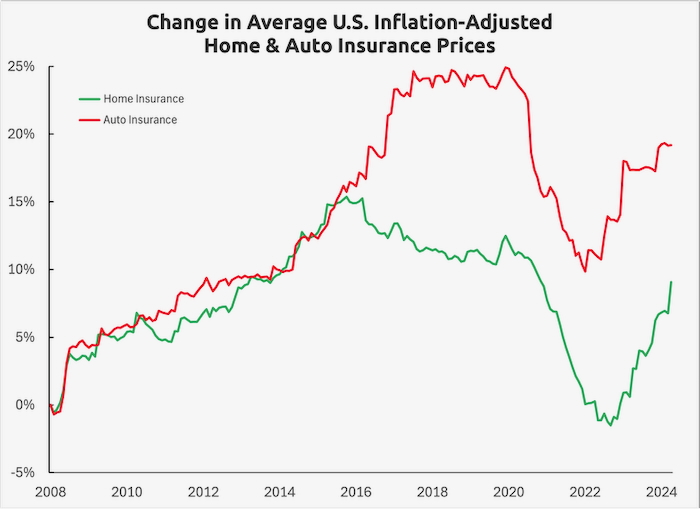

Extreme weather events are becoming more frequent, intense, and expensive, leading to more insurance claims and higher payouts. In 2023, property and casualty losses from catastrophic events in the U.S. totaled an estimated $65 billion. The National Oceanic and Atmospheric Administration (NOAA) tracked 28 separate weather disasters that each caused over $1 billion in damages in 2024. As a result, insurance companies are raising premiums significantly. Between 2021 and 2024, homeowners insurance rates rose 27% nationally.

The impact is even more pronounced in high-risk areas, where rates have climbed even higher. In some cases, homeowners are seeing their premiums double or triple over just a few years. The state of California recently gave State Farm permission to raise rates 17% following the 2025 wildfires.

Consequences for Homeowners

The rising cost of insurance is having a ripple effect on the housing market. States exposed to more natural disasters experience high insurance rates and low housing values, exacerbating America’s affordable housing issues. In some areas, private insurers are backing out, leaving homeowners with limited or no insurance options. According to Cliff Rossi, professor at the University of Maryland and financial risk expert, “In many places of the country, we’re finding that large insurance companies are pulling out altogether, like in California and Florida, as a result of either wildfires that have happened and are raging in those states, or flooding in other states.”

Government’s Role in the Insurance Market

When private insurers withdraw, the government often steps in. Programs like the National Flood Insurance Program (NFIP), managed by FEMA, offer coverage for homes in flood-prone areas. However, the NFIP has been criticized for outdated flood maps, low caps on payouts, and rising premiums. Some states have also created their own insurance programs, but these are often underfunded and vulnerable to collapse in the face of a catastrophic event.

The Future of Home Insurance

The insurance industry is likely to undergo significant changes in response to climate risks. Some companies are moving toward climate-focused underwriting practices that take into account a property’s resilience to extreme weather. Homeowners may need to invest in structural upgrades or consider moving away from high-risk areas. The concept of “climate migration” is being taken seriously by insurance companies, real estate professionals, and policymakers.

What Can We Do?

Addressing the issue requires a multi-faceted approach. In the short term, we need disaster relief programs, storm-proof houses, and affordable insurance options. However, we must also address the long-term problem: climate change itself. By advocating for climate change solutions, we can minimize long-term impacts. Individuals can take action by talking to their friends and family about climate change, electrifying their homes with clean energy, and joining advocacy groups like Citizens’ Climate Lobby.

The future of climate change and insurance depends on our ability to respond to the challenges posed by climate change. By taking action now, we can reduce the risks and create a more sustainable future.