Asian Dividend Stocks Show Resilience Amid Market Volatility

As global markets navigate through economic indicators and geopolitical tensions, Asia’s stock markets have demonstrated resilience, with China’s recent gains fueled by hopes of governmental stimulus. In this environment, dividend stocks offer investors a way to generate income while potentially benefiting from the region’s economic dynamics.

Top 10 Dividend Stocks In Asia

Let’s examine several standout options from the results:

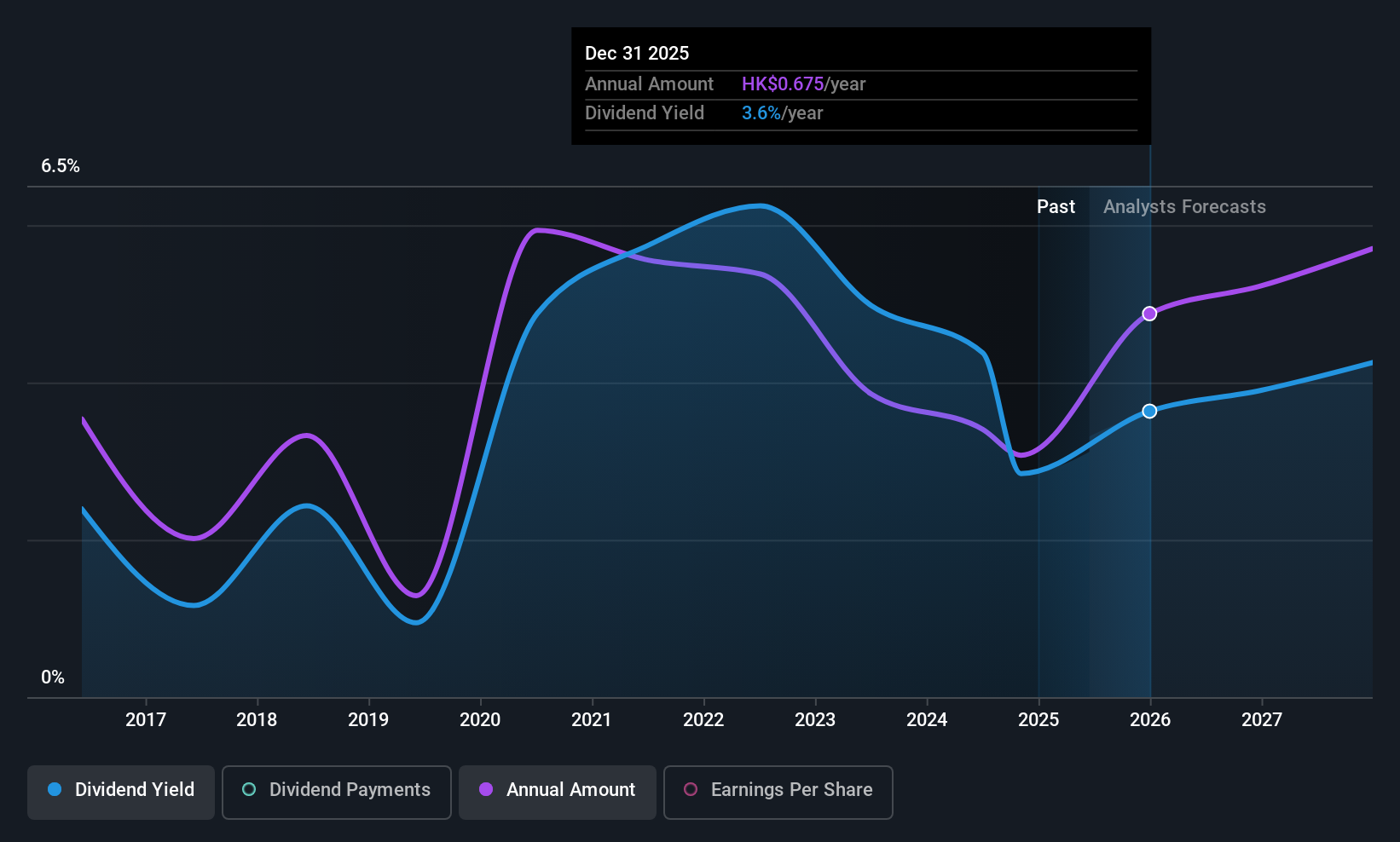

China Life Insurance (SEHK:2628)

- Dividend Yield: 4%

- Simply Wall St Dividend Rating: ★★★★☆☆

China Life Insurance operates as a life insurance company in the People’s Republic of China with a market cap of approximately HK$1.06 trillion. The company’s dividend payments are well-covered by earnings and cash flows, but its dividend track record has been unstable over the past decade. Recent Q1 net income rose significantly to CNY 28.80 billion from CNY 20.64 billion last year.

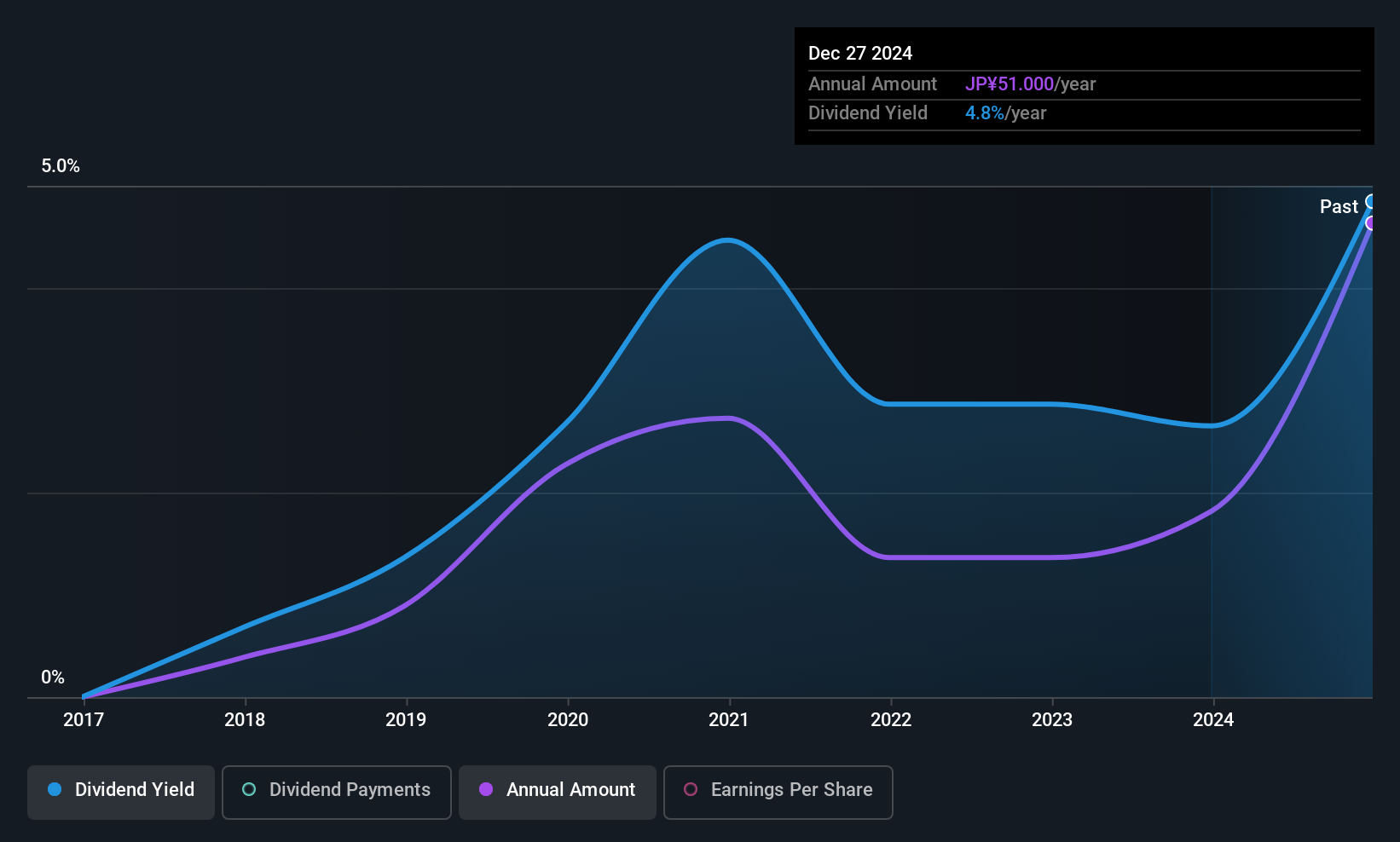

B-Lot (TSE:3452)

- Dividend Yield: 4.5%

- Simply Wall St Dividend Rating: ★★★★☆☆

B-Lot operates in Japan’s real estate and financial consulting sectors with a market capitalization of approximately ¥24.76 billion. The company’s dividend yield places it in the top 25% of Japanese market dividend payers. Despite an unreliable track record, dividends are well-covered by earnings and cash flows.

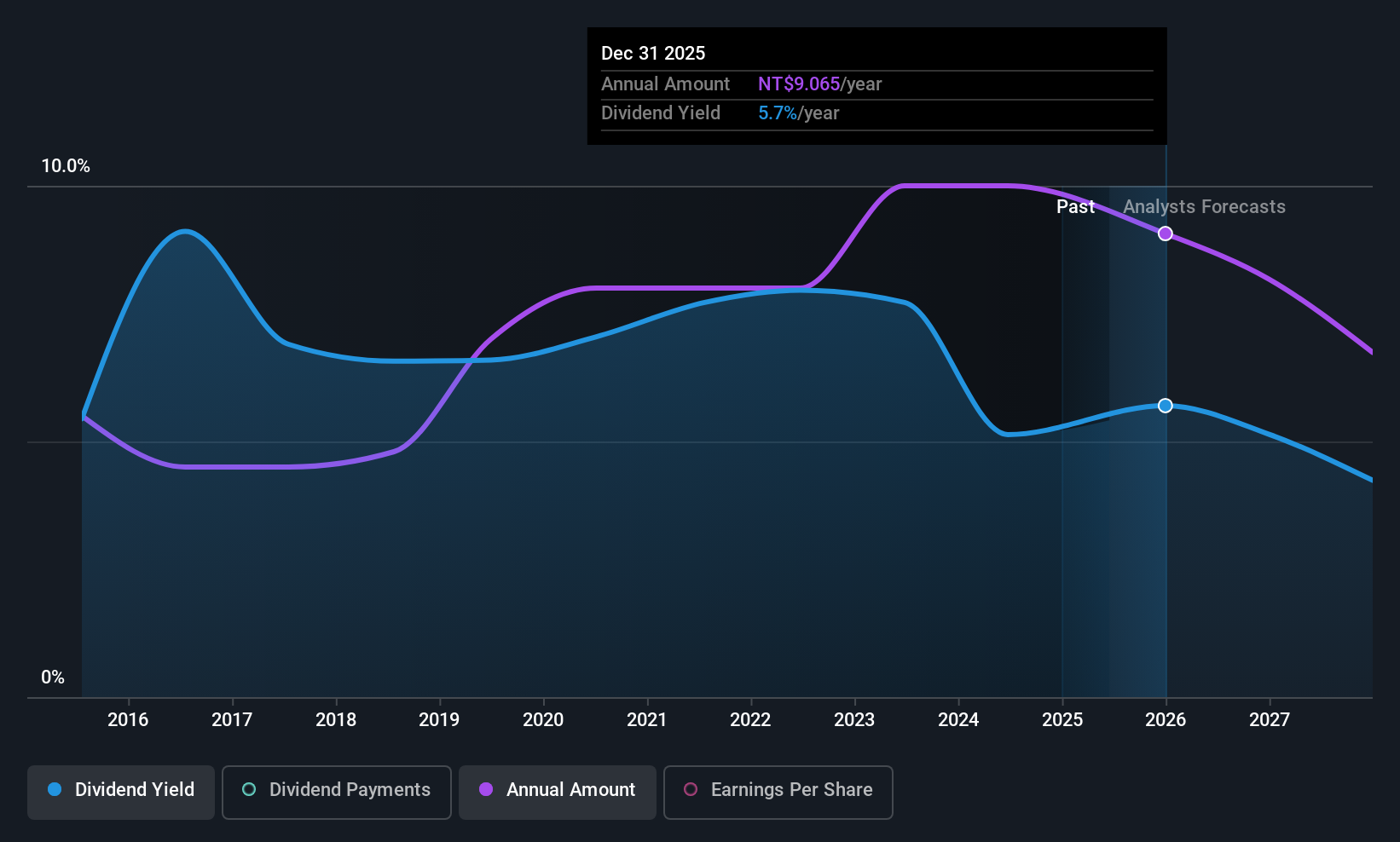

Radiant Opto-Electronics (TWSE:6176)

- Dividend Yield: 6.5%

- Simply Wall St Dividend Rating: ★★★★☆☆

Radiant Opto-Electronics manufactures backlight modules and light guide plates for LCD panels across Asia, Europe, and the United States. The company offers a dividend yield of 6.52%, ranking it among the top 25% in Taiwan. However, high payout ratios suggest dividends may not be well-covered by cash flows or earnings.

Investors can access the full list of 1240 Top Asian Dividend Stocks through Simply Wall St’s screener. It’s essential to conduct thorough research and consider individual financial goals before making investment decisions.