U.S. life insurers are demonstrating financial resilience, according to new research from Morningstar. Despite facing challenges like extended low interest rates, private equity takeovers, and a shift toward potentially riskier investments, the industry is maintaining robust cash liquidity reserves.

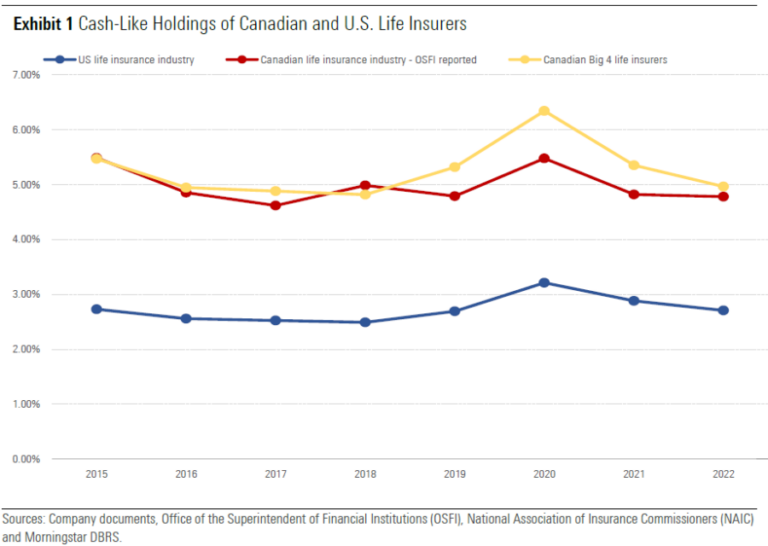

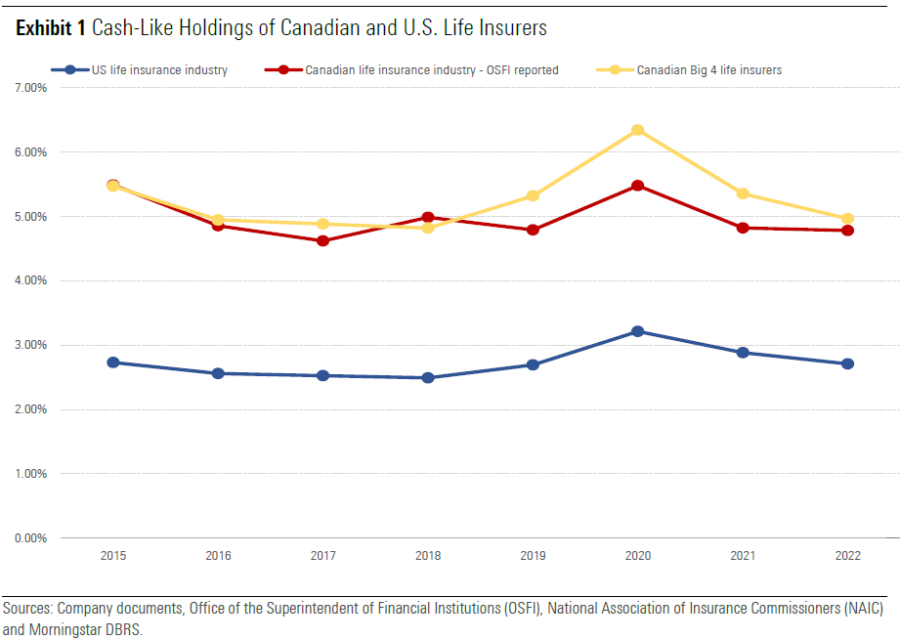

Morningstar’s analysis reveals that cash reserves for life insurance companies trended upwards during the COVID-19-impacted year of 2020. These reserves then settled back to roughly where they stood in 2015, just under 3%. This level exceeds the industry’s cash reserves from 2016 to 2019.

Liquidity, which refers to an insurer’s capacity to fulfill short-term financial obligations is “among the key credit risk considerations for insurance companies given the size and complexity of their insurance and other liabilities,” Morningstar’s report states. Nadja Dreff, Senior Vice President and Sector Lead for Global Insurance & Pension Ratings at Morningstar, emphasized that liquidity is just one of the five core elements assessed in Morningstar’s credit rating process. “Our goal was to just focus on one very small area of liquidity risk management of insurance companies,” Dreff explained. “So, we’re kind of keeping the liability side of insurance policies out of out of the research question.”

One point of focus in this research was a comparison between American and Canadian life insurers, Dreff noted. Morningstar’s findings indicate that insurers north of the border typically hold approximately double the amount of cash reserves that their U.S. counterparts do.

For years, U.S. life insurers have wrestled with the challenge of generating adequate returns from traditional safe investments like bonds. The prolonged period of low interest rates has spurred them to be creative with their investment strategies and partnerships to generate acceptable returns from policyholder funds. Private equity firms have either acquired or formed partnerships with numerous life insurers. This has resulted in a diverse spectrum of asset classes, including private credit on their balance sheets.

“As a credit rating agency, we’re keeping an eye on all these trends,” Dreff stated. “They enter our analysis as we review the credit rating of each of these insurance companies.”

The recent research does not break down cash reserves on a company-by-company basis. The statistics presented are industry-wide. A Morningstar study from last year found that alternative assets, such as real estate, hedge funds, and private equity, constituted less than 10% of insurance companies’ total assets in 2022, the most recent year for which data is available. “However, we recognize that individual companies may have much higher concentrations of riskier assets, which warrants more regulatory scrutiny to ensure that risks are appropriately managed,” Morningstar wrote.

During “market-stress events” like the 2008-2009 financial crisis, U.S. insurers have access to government-backed funding through the Federal Home Loan Banks (FHLB) system. This arrangement gives them an additional liquidity source when needed. “Many insurers maintain an open undrawn liquidity line in order to minimize any delay in accessing the FHLB funds should such a need ever arise,” Morningstar researchers observed. “We view ready-to-access FHLB capacity positively in assessing insurance companies’ liquidity resources.”

As of the third quarter of 2024, the FHLBs have provided $157 billion in advances to 593 insurance company members. This represents an increase from the $111 billion in advances offered to 471 insurers in 2019, according to researchers.

Dreff concluded that the less than 3% cash liquidity levels are not a cause for alarm. “An insurance company is not going to hold a lot of cash,” she said. “There’s an opportunity cost to that. It’s okay to invest, as long as you’re not investing it into very long-term and very illiquid assets.”