Rising Home Insurance Costs in 2025

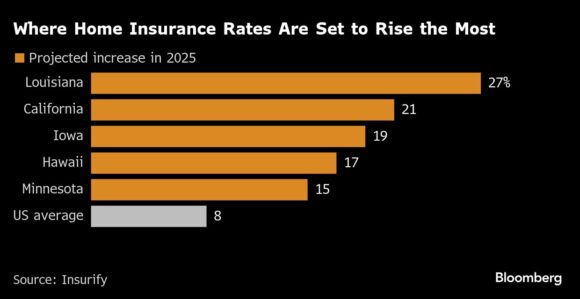

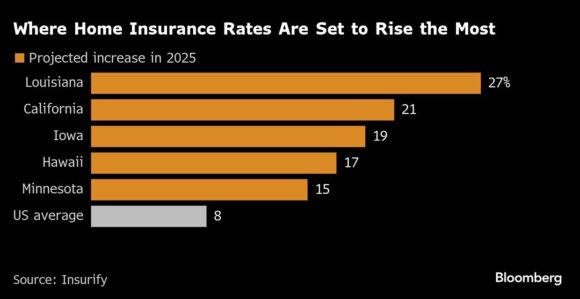

The United States is bracing for a significant increase in home insurance rates in 2025, driven by extreme weather events and the impact of Trump’s tariffs on building materials. According to a new report from Insurify, an insurance policy comparison website, the average annual cost of home insurance is projected to rise by 8% nationally by the end of the year, reaching $3,520 for a home valued at $400,000.

The trend is not uniform across the country. Some states, including Louisiana, Iowa, and Minnesota, are expected to see double-digit increases in home insurance rates. This surge is attributed to the growing frequency and severity of natural disasters, which are, in part, fueled by climate change. For instance, Iowa has experienced an 80% increase in hail storms over the past three years, causing significant roof damage. The state also recorded 131 tornadoes in 2024, tied for the second-highest number in the country.

“The gap between what insurers charge in premiums and what they pay out in losses is shrinking, with some states costing insurers more than they make,” the Insurify report noted. In Iowa, for example, home insurers pay out $122 in claims for every $100 they collect in premiums. This imbalance is driving rate increases across the board.

The situation is further complicated by the tariffs imposed by former President Donald Trump, which are expected to increase the cost of building materials. Since US homebuilders and contractors import materials from countries like China, Canada, Mexico, Japan, and Vietnam – all of which are affected by the tariffs – the construction industry’s supply chain will likely be impacted. “These barriers will impact the construction industry’s supply chain,” said Matt Brannon, an author of the Insurify report. “That, in turn, could raise insurance rates even further due to costlier repairs.”

The increase in home insurance rates is not limited to states traditionally associated with high disaster risk, such as Louisiana and California. Minnesota and Iowa are among the states that are seeing significant impacts from powerful storms, highlighting the widespread nature of the issue.

Home insurance rates have been rising rapidly over the past few years, outpacing inflation. According to the Consumer Federation of America, US homeowners have seen their premiums increase by an average of 24% over the last three years, with a full 95% of homeowners experiencing rate hikes.

The projected increase in home insurance costs is likely to have broader economic implications. “Nationally, home insurance premiums may divert as much as 4.6% of spending away from non-discretionary items and services,” according to Andrew John Stevenson, a senior ESG climate analyst at Bloomberg Intelligence.

As the insurance landscape continues to evolve, homeowners across the US can expect to feel the pinch of rising insurance costs, regardless of their location.