US Life Insurers Report Strong Q4 2024 Earnings

February 28, 2025 – The fourth quarter of 2024 proved to be a successful period for the majority of the ten largest US life insurance companies, according to recent earnings reports. A recent analysis of the data indicates that the sector saw overall revenue increases and a general decline in expenses.

Several key trends emerged from the earnings reports.

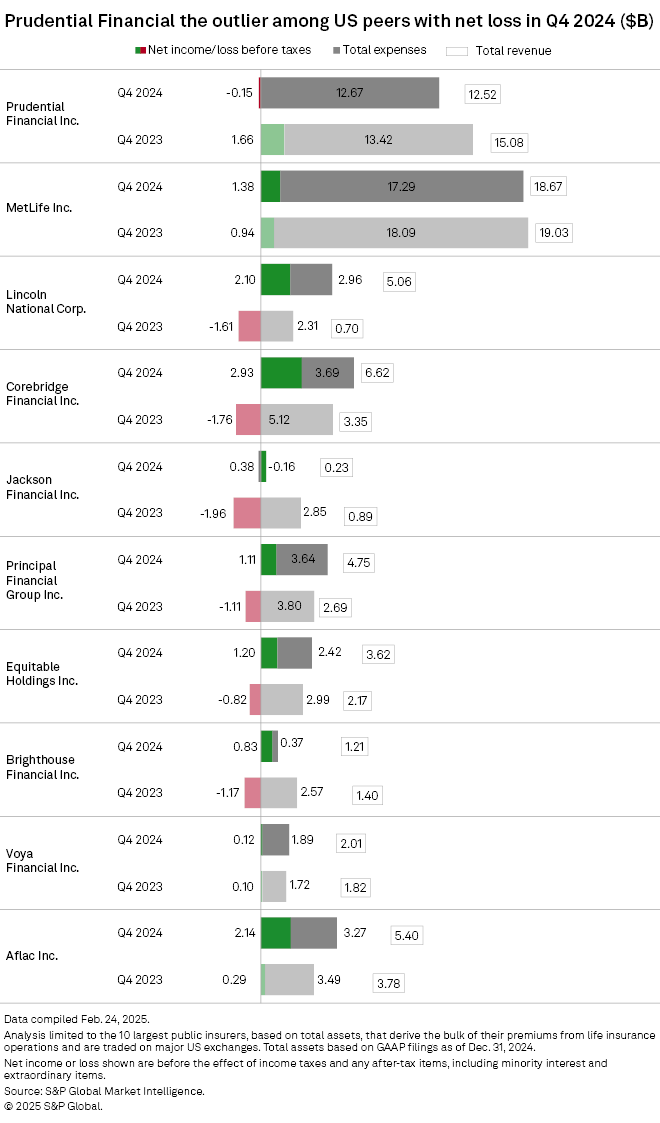

- Revenue Growth: Six of the top ten life insurers experienced year-over-year revenue growth, signaling a positive trajectory for the industry.

- Expense Management: Eight of the top ten companies managed to reduce their expenses in the fourth quarter compared to the prior year. Jackson Financial Inc. led in expense reduction.

- Profitability: The industry saw a return to profitability after a challenging third quarter, during which half of the largest US life insurers reported net losses.

Company Performance Highlights

Lincoln National Corp. led revenue growth, with a substantial increase from $700 million to $5.06 billion year-over-year. This improvement came after the company announced and implemented a multiyear transformation plan.

Image: Lincoln National Corp.

MetLife, Inc. achieved the highest overall revenue for the quarter, totaling $18.67 billion, although this was a drop from $19.03 billion in the prior-year period. They also announced a new partnership to form Chariot Reinsurance Ltd., based in Bermuda.

Globe Life Inc. revealed plans to establish a Bermuda-based reinsurance platform as a subsidiary of the company, aligning with industry trends.

Challenges and Strategic Initiatives

Prudential Financial Inc. reported a net loss of roughly $150 million, which was primarily attributed to investment losses and related adjustments. The company is working to achieve risk-based capital goals.

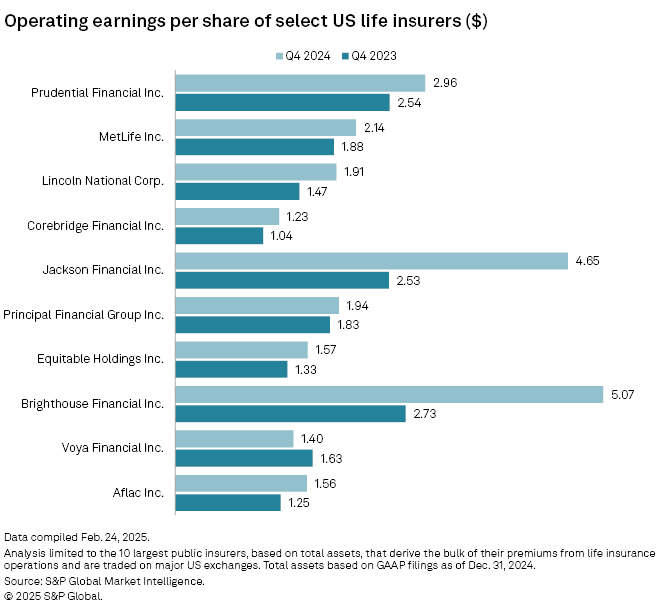

Voya Financial Inc. was the sole insurer in the group to report a decline in earnings, with operating earnings per share dropping to $1.40 from $1.63. The company intends to pursue M&A opportunities and expand partnerships.

Brighthouse Financial Inc. reported the highest operating EPS in the group at $5.07.

The overall trend within the life insurance sector suggests a period of strategic adaptation. The growth in registered index-linked annuity sales and the increasing focus on reinsurance platforms, particularly in Bermuda, indicate that insurers are evolving to manage risk, capitalize on opportunities, and streamline their operations.