Vehicle Insurance Policies Up in Australia

New data from Roy Morgan indicates a substantial rise in vehicle insurance policies in Australia during 2023.

“The latest Roy Morgan data on vehicle insurance policies shows that in the year to October 2023 over 11.3 million vehicle insurance policies were at risk of being switched to another provider, up from around 10.5 million 12 months ago,” says Michele Levine, CEO, Roy Morgan.

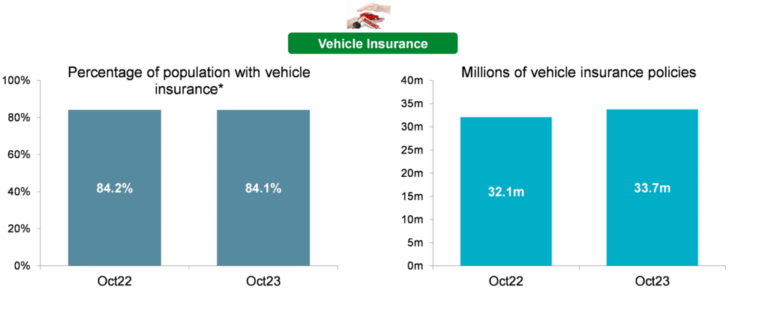

The increase in insurance policies reflects Australia’s growing population following the easing of COVID-19 restrictions. More vehicles on the road have naturally boosted the number of insurance policies, with an increase of 1.6 million between October 2022 (32.1 million) and October 2023 (33.7 million).

Shopping Around for Better Deals

Australians are increasingly looking for better deals on their vehicle insurance policies. The rising cost of living has put pressure on household budgets, prompting consumers to shop around for the best offers, even though many choose to renew with their current provider.

In the year leading up to October 2023, 7.7% of vehicle insurance policies were switched to a different company, which equates to 2.6 million policies. Another 25.9% (8.7 million policies) were renewed after individuals sought quotes from other providers. In total, a significant 11.3 million vehicle policies were shopped around for a better deal.

New Entrants in the Vehicle Insurance Market

The data also highlights the growing number of new entrants purchasing vehicle insurance. This trend indicates a dynamic market with opportunities for insurers to attract new customers.

In the year to October 2023, 6.3% of vehicle insurance policies were purchased by new entrants, representing 2.1 million policies. This is up from 5.9% (1.9 million policies) the previous year.

AAMI, Allianz, and NRMA have captured the largest share of the new entrants’ vehicle insurance policies .

Levine notes that while many policyholders are exploring their options, the majority ultimately stay with their existing insurer. “Of the 11.3 million at risk policies in the vehicle insurance market, the large majority, around 8.7 million, were eventually renewed with the same company,” she said.

She added that the data provides important insights into consumer behavior within the insurance landscape. “These figures show the number of policies at risk of being switched increased in the last year coinciding with the highest level of inflation in over 30 years and the most rapid increase in interest rates this century, up 4% points since May 2022 to 4.1% in October 2023. This appears to be leading people to monitor their ongoing costs closely.”

This information comes from Roy Morgan’s Single Source data, derived from detailed interviews with over 60,000 Australians annually.