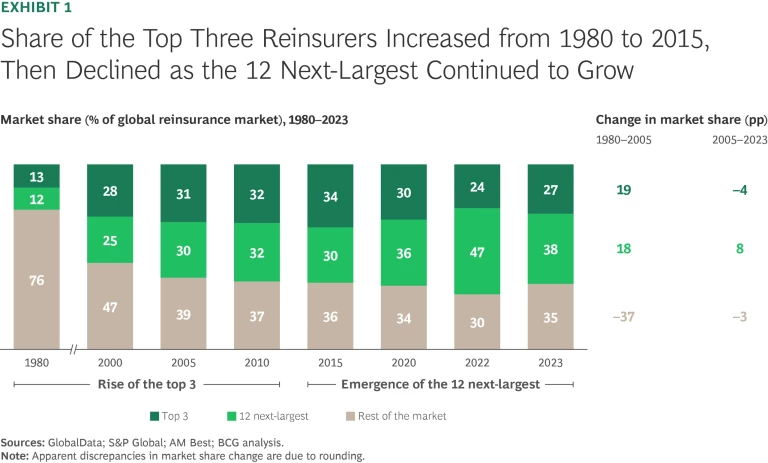

The reinsurance industry has been growing at a steady rate of 5% annually for over 40 years, mirroring the pace of GDP expansion. However, the competitive landscape is becoming increasingly intense, with companies fighting for market share and investors’ capital. The top three reinsurers – Munich Re, Swiss Re, and Hannover Re – have seen their combined market share rise to 34% in 2015 before declining to 27% in 2023. Meanwhile, the next 12 largest companies have steadily gained ground, increasing their combined share from 12% in 1980 to 38% in 2023.

Market Dynamics and Challenges

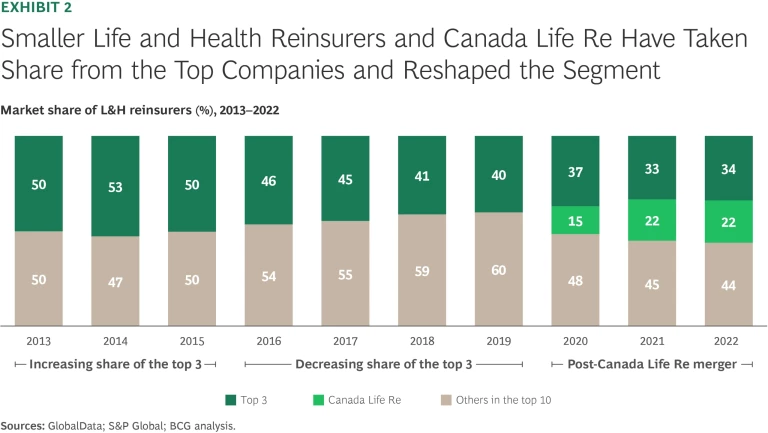

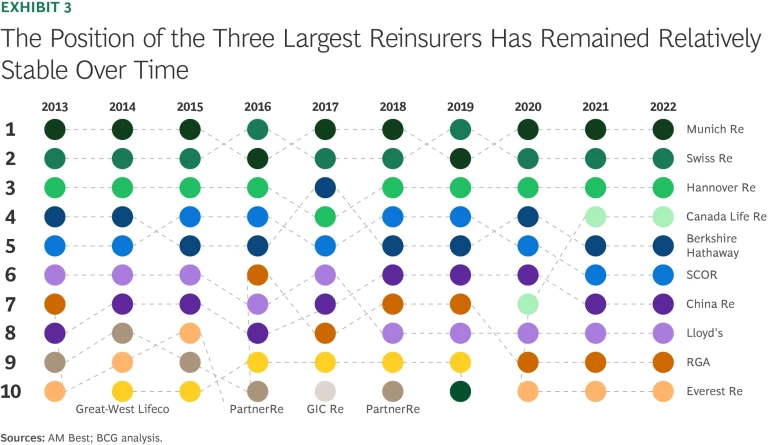

The reinsurance market is characterized by a zero-sum game, where companies compete fiercely for customers’ business and investors’ capital. Mergers and acquisitions have played a significant role in shaping the industry, with Canada Life Re’s consolidation being a notable example. However, sustaining a leadership position is challenging, with only 50% of the top 15 reinsurers maintaining their position over the past decade.

Strategies for Growth

To stay ahead, reinsurers have three organic growth options:

- Expand Their Offering: Reinsurers can explore new avenues for growth by venturing beyond traditional sources of business. Specialty segments such as cyber, climate, and parametric policies are gaining traction.

- Expand Where They Play: Geographic expansion remains a viable strategy, particularly in high-growth regions with rising insurance demand.

- Expand Their Relationships: Deepening relationships with existing clients and brokers is crucial for new business opportunities.

Alternative Paths

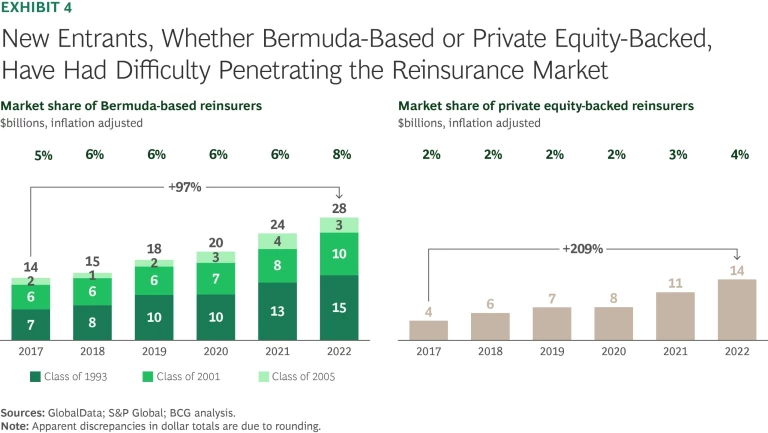

In addition to organic growth, reinsurers can consider moving faster through M&A, which can quickly increase scale and bring new capabilities in-house. However, this path is narrow for most players due to the limited availability of suitable targets. Alternatively, some companies may decide to step aside and withdraw from the market if reinsurance is no longer an attractive strategic play.

The Need for Decisive Action

Whatever course reinsurers choose, they must act with boldness, backed by a sharp analysis of the landscape, a clear strategy, and decisive execution. The path to relevance is narrowing, and companies must be proactive to secure a stronger place in the market or risk being left behind.