Worried About Data Breaches? Here’s How to Freeze Your Credit

Data breaches happen almost every day, impacting numerous industries. Freezing your credit offers a free method to protect your identity. After weeks of deliberation, I decided to freeze my credit. As a personal finance editor covering identity theft, I knew it would make it more difficult for cybercriminals to open new credit accounts in my name.

Freezing your credit requires manually unfreezing or “thawing” it with each of the three major credit bureaus whenever you wish to apply for a new credit card, car loan, or mortgage.

The process, however, isn’t entirely straightforward. It requires signing up for individual accounts with Equifax, TransUnion, and Experian. However, two key benefits convinced me: It is free, and it gives peace of mind, knowing you’ve neutralized a major identity theft tactic.

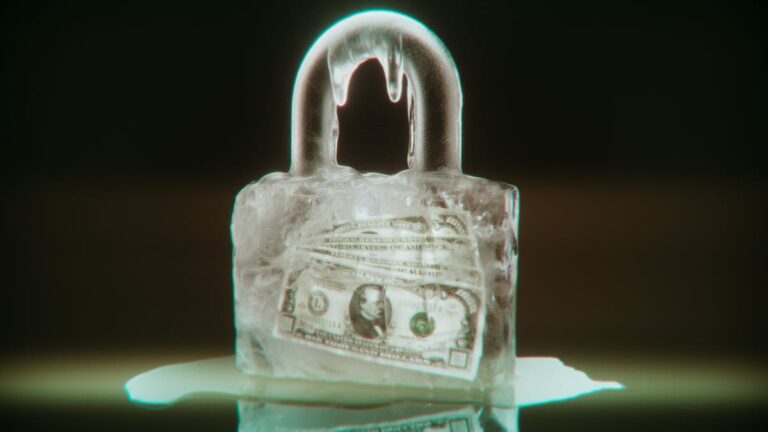

The padlock graphic represents a credit freeze.

Why Freeze Your Credit?

Data breaches occur frequently across different sectors. Your personal data has likely been compromised at least once. In 2024, Ticketmaster, AT&T, and several other companies reported data breaches affecting millions of customers, compromising personal data. Freezing your credit offers peace of mind if you’re worried about people opening new credit accounts in your name.

I’ve noticed an increase in scam messages on my phone and in my email over the past year. While most are easy to identify, some are well-researched. The constant barrage makes me aware I could fall victim to a scam that could lead to identity theft.

Freezing credit is one of the most effective ways to protect your data and money. Identity thieves might still access your information via existing accounts, but you can still limit the damage.

How to Freeze Your Credit

To freeze your credit, you need to contact each of the three major credit bureaus. This involves creating accounts, which takes approximately 30 minutes online. You will typically be asked for your name, date of birth, and the last four digits of your Social Security number. Then, you’ll need to complete two-factor authentication via text or email.

TransUnion and Equifax have dedicated tabs on your dashboard to freeze your credit. Experian’s option is a bit less obvious. You can hover over “credit” on your dashboard and click “Experian Credit Lock,” their paid service, and the free security freeze option can be found there. Experian also has a link at the bottom of the page. All three credit bureaus will confirm your credit freeze via email.

If you prefer not to set up online accounts, you can call each credit bureau:

- TransUnion: 800-916-8800

- Equifax: 888-298-0045

- Experian: 888-397-3742

After you request a credit freeze, each bureau must freeze your credit within one business day. When you need to unfreeze your credit, they are required to thaw your credit within an hour. By mail, it may take up to three business days to complete the process.

Downsides to Consider

While freezing your credit can be beneficial, there are downsides:

- Unfreezing for New Accounts: You must unfreeze your credit each time you want to open a new account. This prevents cybercriminals from opening accounts, but also impacts you. It’s best to wait before freezing your credit if you plan to apply for a new credit card, mortgage, or car loan.

- False Sense of Security: Freezing your credit is a good step but won’t solve all your identity theft worries. Consider signing up for an identity theft protection service to monitor your credit, bank accounts, and the dark web. You can also use free tools like reviewing your monthly statements and credit reports.

- Spam Messages: It won’t stop spam messages. Scammers can still try to gain access to your information via existing accounts. Block unrecognized numbers and email senders, and read messages carefully.

- Credit Offers: Credit freezes also won’t eliminate spam mail and prescreened offers. Financial institutions you already have a relationship with and debt collectors can still view your credit. Credit monitoring companies can still provide you with your up-to-date credit scores.

- Password Hygiene: Even with a frozen credit, you need to use good passwords. Avoid using the same login information across multiple sites. Consider using a password manager.

- Bank Account Protection: It won’t protect your bank account information. Protect your bank accounts from scammers by changing your password immediately after you provide any information to cybercriminals.

In Conclusion

While there are pros and cons to freezing your credit. I am glad I did.